It's All About the Metals

February 2, 2026

Market Roundup for the Week

This was the final trading week for the month of January. It can be defined by a classic "rollercoaster" pattern: a bullish breakout to all-time highs followed by a violent Friday reversal. While the major indices ended January in the green, the week was a battleground between blockbuster earnings and a major shift in the Federal Reserve's future.

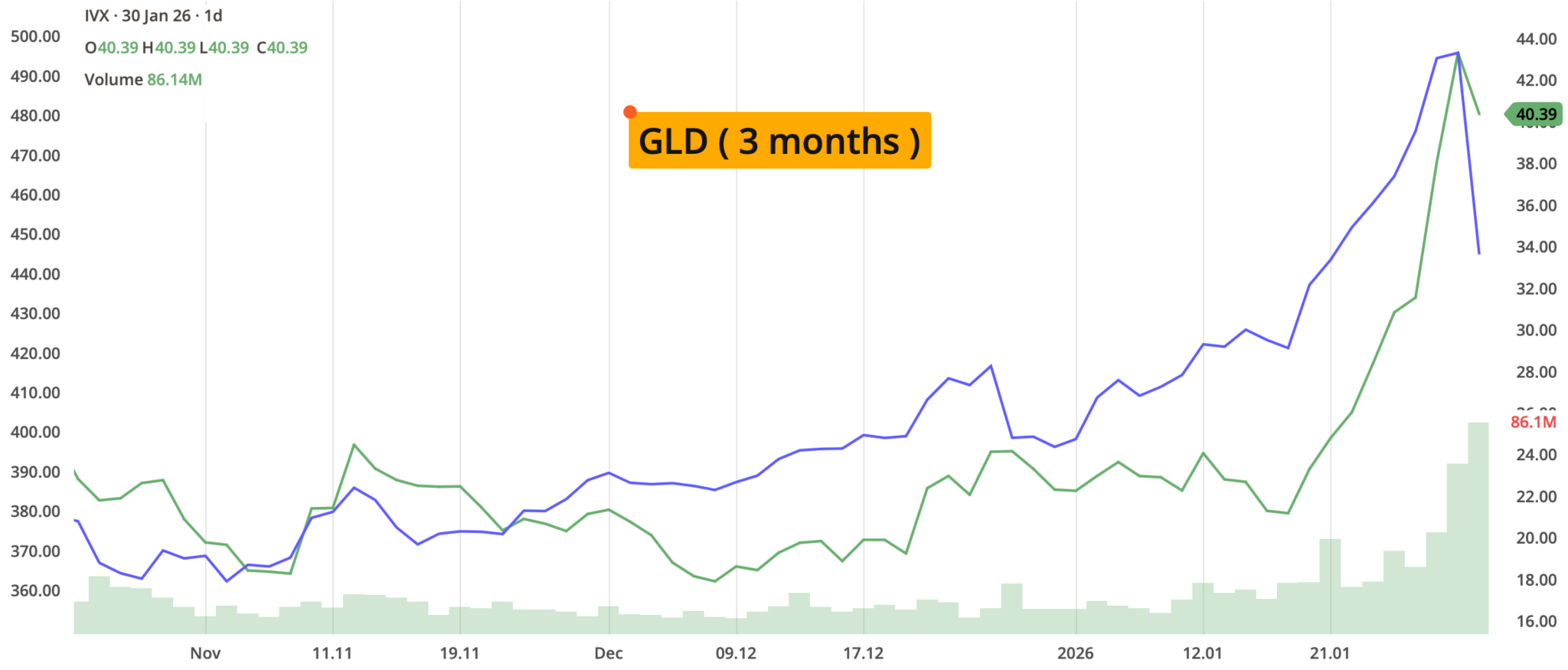

The week began with intense optimism. The SPY briefly breached the psychological 7000 level and metals went parabolic with gold surging past $5500 and silver touching $120. The metal fever could be assigned to a weak US Dollar and geopolitical safe-haven demand.

As expected, the Fed Pause was confirmed when the Federal Reserve held interest rates steady at 3.50%–3.75%. Chair Powell's commentary suggested that the labor market was stabilizing, which initially kept the "soft landing" narrative alive.

The final 2 trading days of the week (and month) had 2 major catalysts that royally roiled the markets.

- The nomination of the next Fed Chair, Kevin Warsh, spiked yields as traders priced in a Fed Chair with a reputation of being "more hawkish".

- Gold and silver suffered a violent "flush out" with gold dropping nearly 10% and silver cratering 28%. Reports were of margin calls and profit-taking hitting the over-extended metals.

Oil prices continue to climb as a US armada approaches Iran, with President Trump warning that "time is running out" for the country to make a nuclear deal.

The first half of January is usually termed the "January Effect" rally but, this year, the final week can be termed the "Reality Check". Traders experienced a clear split in AI–the market rewarded companies showing immediate revenue (Meta) and punished those with high "spend" but slower returns (Microsoft). If asked for a "big picture" review, Friday marked a "reset" for the year. The "Trump Trade" of 2025–long gold and long tech–hit a major speed bump as the reality of a new Fed regime and geopolitical tariff risks began to sink in.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger (or smaller) to suit individual account size.

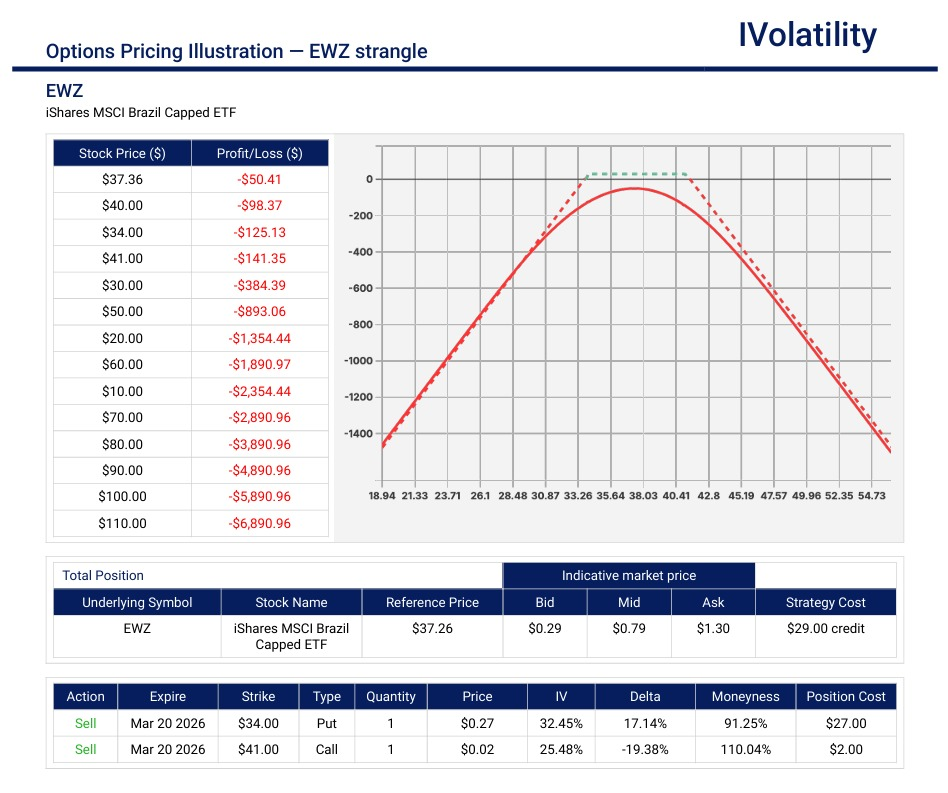

- EWZ (closed at 37.05 on Friday, Jan 30th)

If a trader wishes to add some diversification to the portfolio, a non-US etf could be considered. EWZ is the ticker symbol for the iShares MSCI Brazil ETF, an exchange-traded fund that provides investors with targeted exposure to the Brazilian stock market. It is the largest and most liquid ETF for those looking to invest in Brazil's economy.

Sell the Mar20, 34/41 strangle

Premium collected about $80/contract

Probability of profit about 65%

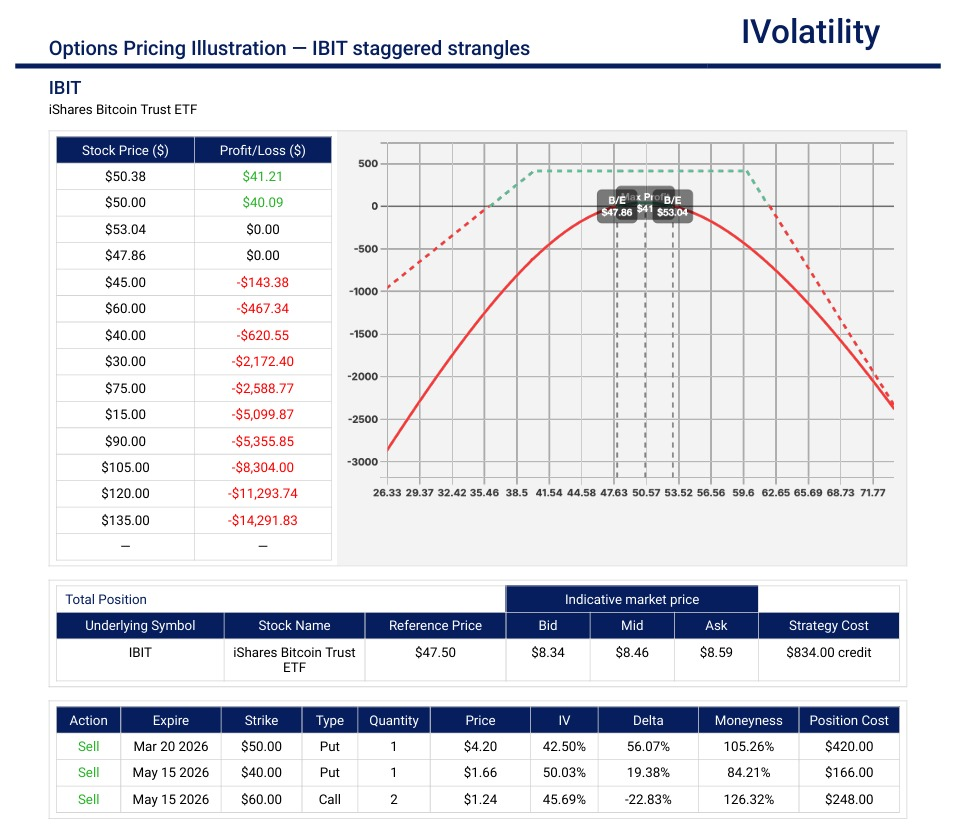

PnL Calculator from the IVolLive Web - IBIT (closed at 47.50 on Friday, Jan 30th)

The iShares Bitcoin Trust (IBIT) has experienced significant volatility over the past three months (November 2025–January 2026), mirroring the price action of Bitcoin. As of late January 2026, the fund's 3-month performance is down approximately 24%.

If a trader would like to get bullish at these levels, a position consisting of staggered strangles could be considered.

Sell ONE Mar20 50put / Sell ONE May15 40put / Sell TWO May15calls

Net position delta is +40

Premium collected is about $850

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

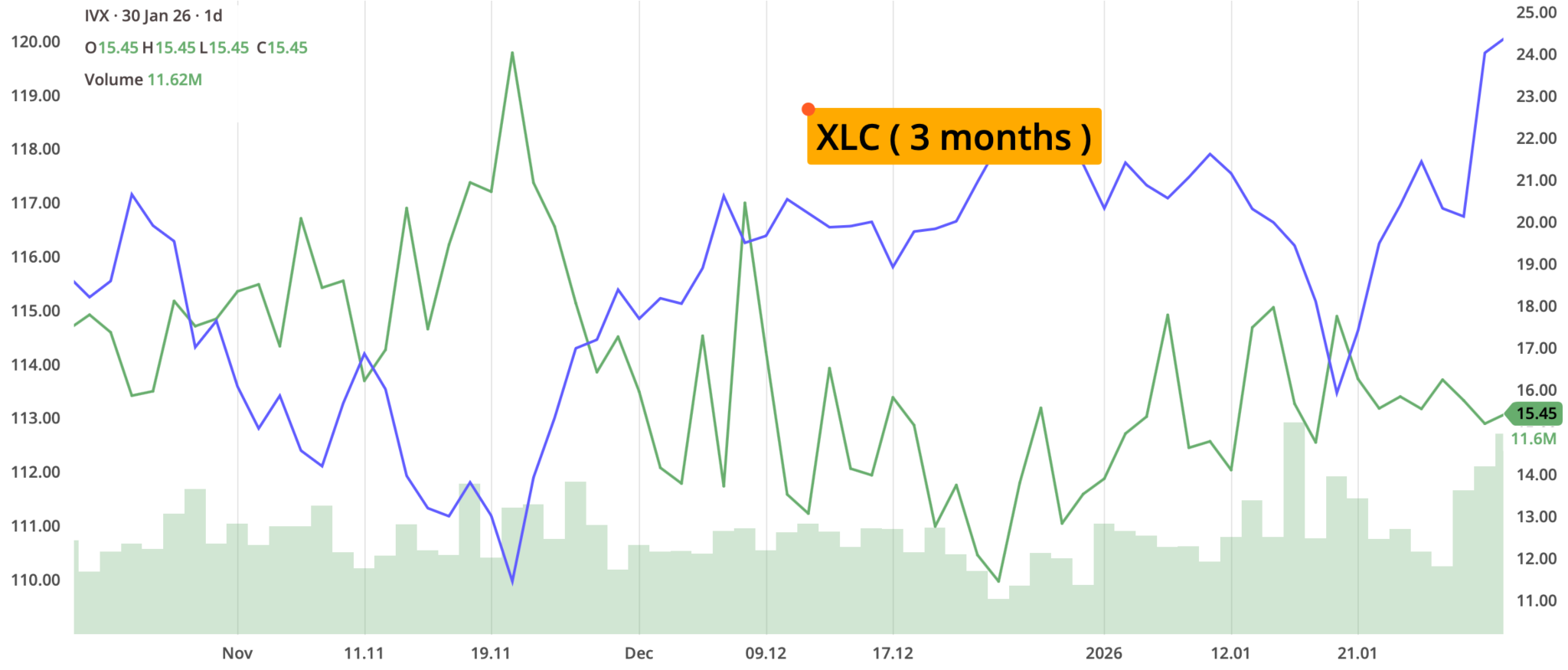

During the final week of January 2026, the markets experienced significant volatility. The week began with a rally in tech and gold, but most indices "hit a wall" on Friday, January 30, due to a broad sell-off following disappointing healthcare sector news and a pullback in momentum stocks.

| INDEX | UP | DOWN |

| SPY | 0.11% | |

| QQQ | -0.14% | |

| IWM | -2.19% | |

| DIA | -1.24% | |

| GLD | -3.43% | |

| BTC/USD | -2.71% | |

| TLT | 1.27% | |

| Crude Oil | 7.43% | |

| VIX | 4.02% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | -0.96% | |

| FINANCIALS (XL) | 0.66% | |

| INDUSTRIALS (XLI) | 0.74% | |

| ENERGY XLE | 2.37% | |

| HEALTHCARE (XLV) | -1.67% | |

| UTILITIES (XLU) | 1.29% | |

| MATERIALS (XLB) | -2.28% | |

| REAL ESTATE (XLRE) | 0.05% | |

| CONSUMER STAPLES (XLP) | 0.55% | |

| CONSUMER DISCRETIONARY (XLY) | -1.54% |

Notable gainers for the week of 26th–30th:

While the week was marked by extreme volatility and a late-week sell-off, several companies posted standout gains. These were primarily driven by "blowout" earnings reports, aggressive 2026 guidance, and the continued "flight to quality" within the AI and energy sectors.

Meta Platforms (META) was the undisputed winner of the week, surging nearly 10% after its earnings release. Meta delivered a record $59.9 billion in quarterly revenue and, more importantly, provided first-quarter guidance that was significantly higher than Wall Street estimates. Investors rewarded the company for proving that its massive AI investments are translating into real advertising dollars.

Southwest Airlines (SWA) took the "transformation play" award and had one of its best weeks in years, ending near a 52-week high. The shares jumped nearly 16% due to a forecasted massive growth of 330% in profits for 2026. Investors cheered the company's aggressive business model transformation, which included the launch of assigned seating, extra-legroom options, and new ancillary fees designed to boost margins.

Caterpillar (CAT) hit a new all-time high mid-week, solidifying its role as a backdoor play on the AI boom. CAT reported record quarterly earnings and a massive $51 billion backlog. The standout was its Power Systems division, which saw a 23% revenue jump due to the explosive demand for backup generators used in AI data centers. CAT is now called the AI Industrial leader.

CoreWeave (CRWV) surged over 6% after Nvidia invested another $2 billion in the company, reinforcing CoreWeave's position as the preferred cloud platform for AI workloads.

Palantir (PLTR) gained momentum heading into its earnings, finishing the week up roughly +3.5% as retail and institutional interest in its "AIP" platform continued to grow.

Kosmos Energy (KOS) remained one of the top gainers of the month, ending the week up over +5% as geopolitical tensions kept a floor under energy prices.

Baker Hughes (BKR) led the S&P 500 on Monday with a strong rally after delivering a profit report that beat analyst expectations.

Notable losers for the week of January 26th–30th:

The markets seemed to indicate zero tolerance for high-valuation companies that don't provide a "perfect" outlook. Solid earners (like Microsoft and ServiceNow) were punished since their spending on AI does not seem to show an immediate, massive return on investment.

While the week saw some tech giants like Meta surge, it was a brutal period for the healthcare, software, and gaming sectors. The most notable losses came from companies that missed growth expectations or were hit by sudden regulatory changes.

Humana (HUM) dropped 14% as its business model is highly dependent on Medicare Advantage and the news that Medicare costs would not increase did not help.

UnitedHealth Group (UNH) dropped nearly 20% after a disappointing revenue forecast.

Microsoft (MSFT) dropped 10% despite beating earnings estimates and triggered a sector-wide sell-off in software as investors fretted over the high cost of AI infrastructure and slowing cloud growth. Its worst single-day drop in years, wiping out billions in market cap.

ServiceNow (NOW) fell nearly 14% despite an earnings beat, as the market entered a "sell the news" cycle for AI stocks.

Revolution Medicines (RVMD) plummeted nearly 20% after merger discussions with Merck reportedly stalled.

Las Vegas Sands (LVS) dropped 14% following a weak quarterly report and concerns over Macau travel trends.

Capital One (COF) sold off nearly 8% after reporting a significant earnings miss.

American Airlines (AAL) sold off 7% after a quarterly profit miss and concerns over winter storm disruptions.

Tesla (TSLA) dropped nearly 4% based on investors disappointment with declining year-over-year margins, despite a headline "beat" on profit.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

US equities climbed as investors braced themselves for a deluge of earnings, with one-third of the S&P 500 set to report this week, including four members of the Magnificent 7.

Gold roared briefly above $5100 per ounce as investors sought safety following a weekend of domestic and international political upheaval. Gold was partially driven by anxieties over President Trump's threats to impose 100% tariffs on Canada this weekend due to its trade dealings with China and fears of a possible partial government shutdown over ICE funding. The jolt added momentum to last week's rally, propelled by the US–Europe standoff over Trump's Greenland annexation aspirations and Japan's bond market meltdown.

Silver crossed $100 while natural gas soared after Winter Storm Fern knocked out an estimated 10% of natural gas production across the county.

About 19,000 flights were cancelled due to the winter storm over the weekend.

The yen climbed today after Japanese officials indicated the government might intervene in preventing the currency's decline.

Polymarket just inked a multi-year deal with Major League Soccer and bettors placed $6 million on how many inches of snow New York City received over the weekend.

Monday's Movers to the Upside:

- Apple rallied nearly 3% after unveiling a new AirTag with expanded range and improved item tracking.

- GameStop rose nearly 4.5% after Michael Burry disclosed he's been buying the stock.

- Mining companies (SSR and Newmont and Freeport-McMoran) rose as gold futures pushed past $5,000.

- Sarepta Therapeutics jumped nearly 8% on positive three-year trial results for its Duchenne muscular dystrophy drug, Elevidys.

- SkyWater Technology gained over 3% after agreeing to be acquired by quantum computing company IonQ in a $1.8 billion deal.

- Brand Engagement Network surged over 250% following the announcement of a joint venture with Valio Technologies to develop an AI licensing framework.

- Lands' End gained over 30% after forming a joint venture with WHP Global to expand its brand platform.

Monday's Movers to the Downside:

- Sweetgreen slid 7%, Cracker Barrel sank 4%, and CAVA dropped nearly 6% as a major winter storm disrupted traffic and weighed on restaurant sales.

- JetBlue Airways lost over 3.5% after the airline was forced to cancel over half of its flights today.

- Booz Allen Hamilton tumbled 8% after the US Treasury cut contracts with the firm following a tax data leak tied to a former contractor.

- Rare Earth USA got a boost from the US government.

- Revolution Medicines sank over 16% after Merck walked away from acquisition talks, citing an inability to agree on price.

Tuesday's Markets and News:

The S&P 500 climbed to a new record high as investors looked to upcoming earnings reports, while the Dow Jones slipped, weighed down by a drop in UnitedHealth shares.

The dollar slid to its lowest level since February 2022 as the US signaled support for a stronger yen, fueling speculation of coordinated currency action.

President Trump announced he's increasing tariffs on imported South Korean autos, pharmaceuticals, and lumber from 15% to 25%. Meanwhile, the European Union and India inked a free-trade agreement, creating a free-trade zone set to double EU goods exports to India by 2032.

US consumer confidence plummeted to its lowest level since 2014.

Airlines cut even more flights across the US as another winter storm approaches.

Amazon announced a shutdown of all of its Amazon Go and Amazon Fresh stores.

Tuesday's Movers to the Upside:

- Corning rose over 15% after Meta agreed to pay up to $6 billion over several years for fiber-optic cables for its AI data centers.

- General Motors gained nearly 9% after boosting its dividend and launching a new $6 billion share buyback, citing expectations for profit growth following a strong year.

- Sysco jumped nearly 11% after reporting fiscal Q2 results that beat expectations.

- Orsted rose 5% after European countries agreed to expand offshore wind capacity in the North Sea.

- Micron Technology climbed over 5% after outlining plans to invest $24 billion in Singapore over the next decade to meet AI-driven chip demand.

Tuesday's Movers to the Downside:

- Pinterest fell over 9.5% after announcing layoffs and revealing plans to prioritize AI.

- Boeing slid over 1.5% despite reporting better-than-expected earnings, with gains driven largely by an asset sale.

- Reddit dropped 8% after an analyst raised concerns about slowing growth prospects into 2026.

- Roper Technologies declined nearly 10% after missing fourth-quarter revenue estimates.

- Sanmina fell over 20% despite beating Q4 expectations.

- American Airlines sank 7% after missing Q4 expectations and saying last year's government shutdown shaved roughly $325 million from revenue.

Wednesday's Markets and News:

The Federal Reserve kicked off 2026 by keeping interest rates parked between 3.5% and 3.75%—despite two governors (both Trump appointees) pushing for a quarter-point cut.

"The US economy expanded at a solid pace last year and is coming into 2026 on firm footing. Inflation has eased significantly from its highs in mid-2022, but remains somewhat elevated relative to our 2% longer-run goal", the Fed Chair Powell elaborated.

This is the Fed's first break in rate cuts since July, following a quarter-point trim at each of the central bank's final three meetings of 2025. This end-of-year trifecta sent investors cheering and mortgage rates to near three-year lows, though everyone knew this rate-slashing party couldn't last forever.

The S&P 500 touched 7,000 for the first time ever this morning, buoyed by strong earnings from chip stocks.

The Russell 2000 has gained 6.14% since the start of the year—outpacing the S&P 500's gain of 1.94% over the same period. Small-cap stocks are crushing their larger peers as investors anticipate strong economic growth in 2026.

Gold continued to shine with safe haven asset having jumped 19.54% over the past month. Gold propelled above $5,300 per ounce for the first time ever today.

Geopolitical fears have helped buoy the hot commodity, as has a decline in the US dollar.

Oil climbed to a four-month high after President Trump warned Iran that a "massive armada" is on the way.

Wednesday's Movers to the Upside:

- Seagate, Western Digital, SanDisk and Micron Technology all enjoyed massive surges in their prices as analysts flagged durable, long-run demand for storage products.

- Intel gained over 11% on reports that Nvidia and Apple are planning to shift some chip manufacturing away from TSMC and toward Intel.

- AT&T rose over 4.5% following a Q4 beat and a full-year outlook that came in above forecasts.

- Texas Instruments advanced nearly 10% after issuing a stronger-than-expected earnings forecast for Q1.

- Stride jumped over 14% after the education company beat expectations and issued an upbeat full-year revenue forecast driven by strong demand.

Wednesday's Movers to the Downside:

- Starbucks sank nearly 0.6% after missing fiscal first-quarter earnings estimates, though it did post traffic growth for the first time in two years.

- ASML fell over 2% after reversing earlier gains despite reporting record orders and issuing strong 2026 guidance tied to the AI boom.

- Electronic connector manufacturer Amphenol slid over 12% even after posting better-than-expected Q4 results and guidance, as lofty expectations followed a 140% rally over the past year.

- VF Corporation dropped nearly 6% despite reporting strong fiscal third-quarter results.

- Defense and aircraft manufacturing conglomerate Textron slipped nearly 8% after beating fourth-quarter expectations but issuing weak forward guidance.

- Qorvo fell nearly 7% after topping fiscal Q3 earnings estimates but missing outlook expectations, dragging down Skyworks Solutions nearly 8% amid investor focus following their recent merger agreement.

Thursday's Markets and News:

Market movement today can be defined by extreme "whipsaw" volatility, particularly in the tech and precious metals sectors. While the major indices ended the day with only modest changes, the path to get there involved dramatic midday sell-offs and a historic "shaking of the tree" in the gold market.

The most "violent" price action occurred in the metals market. Early in the day, spot gold hit a staggering new all-time high near $5,600/oz. In a matter of hours, there was a flash crash and gold plunged back toward $5,170, as the "fever" in the market appeared to break.

Traders characterized Thursday as a "blow-off top" for gold and a "distribution day" for tech. The fact that indices "pared" their losses late in the day suggested there was still dip-buying appetite, but the cracks in the AI narrative and the exhaustion in the gold rally were the day's true themes.

The day featured a fierce battle between two tech giants that dictated the direction of the S&P 500 and Nasdaq. MSFT suffered its worst drop since 2020, plummeting 10%. Despite beating earnings estimates, investors were spooked by surging capital expenditures for AI and a slowing growth outlook for its Azure cloud business.

Offsetting Microsoft's drag was Meta Platforms (META), which surged over 10% after an upbeat revenue outlook. This "clash of the titans" kept the broad market from a total meltdown. The S&P 500 fell as much as 1.5% midday before rallying back to close down just -0.1%.

The Senate failed to clear a key hurdle ahead of Friday's deadline to fund the government or partially shut it down.

Thursday's Movers to the Upside:

- Meta Platforms delivered a blockbuster earnings report and the stock jumped over 10%. While other tech giants like Microsoft faced skepticism over AI spending, investors cheered Meta's ability to turn massive infrastructure investments into immediate, tangible profits.

- Royal Caribbean jumped over 18.5% after beating Q4 estimates and issuing 2026 earnings guidance that blew past forecasts, with bookings hitting a record seven-week stretch.

- Caterpillar rose over 3.4% as Q4 profits topped estimates, fueled by surging demand for power-generation equipment tied to AI data centers.

- IBM climbed over 5% after beating Q4 estimates and forecasting full-year revenue growth above 5%.

- Southwest Airlines gained nearly 20% after projecting a sharp jump in 2026 profits.

- Honeywell advanced nearly 5% following a Q4 earnings beat.

- Lockheed Martin popped over 4% despite a Q4 earnings miss, after topping sales forecasts, issuing strong 2026 guidance, and announcing a new missile deal.

Thursday's Movers to the Downside:

- Tesla shares rose at the open then fell nearly 3.5% by day's end as traders digested the company's transition from EV maker to robot manufacturer.

- ServiceNow fell nearly 10% as AI disruption fears overshadowed a Q4 beat.

- Las Vegas Sands dropped nearly 14% after disappointing Q4 results in Macau, where EBITDA came in at $608 million, below management's expectations.

- United Rentals sank nearly 13% after missing estimates on both Q4 revenue and earnings.

- International Paper fell 6% on the news that it will split into two publicly traded companies.

- Dow Chemical slipped over 2% after announcing a restructuring plan alongside a deeper net loss.

Friday's Markets and News:

Friday's market movement can be characterized as a violent "de-risking" event with a historic reversal in the precious metals market. The "crash" in gold and silver wiped out billions in paper wealth in a matter of hours. Gold and silver plummeted while the US dollar soared in its best day since July following President Trump's nomination of Kevin Warsh for Federal Reserve chair.

While the major stock indices ended the week with a relatively modest "sluggish" close, Tech stocks continued to weigh down indexes, pushing the S&P 500 lower for a third day in a row. Keep in mind that, despite the recent declines, January was still the S&P 500's best month since last October.

Friday's Movers to the Upside:

- Apple eked out less than a 0.5% gain after beating Wall Street estimates on revenue and earnings. Despite outstanding earnings, CEO Tim Cook did warn that a global memory crunch could pressure margins going forward.

- Sandisk jumped nearly 7% after issuing a stronger-than-expected revenue and earnings outlook, pointing to improving demand across memory markets.

- Verizon gained nearly 12% thanks to the addition of 616,000 net postpaid phone subscribers in Q4, a six-year high.

- Deckers Outdoor climbed nearly 20% after reporting record revenue and profit in fiscal Q3 and raising its full-year outlook.

- Stryker advanced over 4% following a Q4 earnings beat and guidance for solid revenue growth in 2025, driven by strength in its vascular business.

- GameStop rose over 4.5% after unveiling plans to acquire a publicly traded company, potentially in the consumer or retail space.

Friday's Movers to the Downside:

- Miners sank as gold and silver prices tumbled. Companies included Newmont, Kinross Gold and Freeport-McMoRan.

- Western Digital declined over 10% despite posting better-than-expected fiscal Q2 results.

- Visa dropped 3% even after topping fiscal Q1 estimates, as the total number of processed transactions came in below consensus.

- KLA slipped over 15% after beating earnings expectations, with investors unimpressed by management's outlook.

- SoFi Technologies sank over 6% even after reporting Q4 revenue growth of 39%.

- Video game stocks tumbled on the news that Google has developed an AI model that creates digital worlds with written prompts. Unity Software dropped over 24%, Take-Two Interactive lost nearly 8%, and Nintendo fell nearly 5%.

Notable Earnings to be announced Feb 2nd–Feb 6th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

The coming week is arguably the most critical week of the Q4 2025 earnings season. Investors will pivot from a week of mixed "Magnificent 7" results (where Meta surged but Microsoft slumped) to a fresh wave of AI, chip, and consumer giants.

Monday: DIS / PLTR / NXPI

Tuesday: AMD / MRK / PEP / AMGN / PFE / CMG / SMCI / PYPL

Wednesday: GOOGL / LLY / UBER / QCOM / CME

Thursday: AMZN / COP / EL / RDDT / ILMN / BMY / AFRM / RBLX

Friday: UA / UA / PM

Key Economic Indicators due from Feb 2nd–Feb 6th:

All eyes turn to the labor market next week. While the Fed's decision is confirmed, the central banks around the globe will make their latest policy decisions:

The daily schedule of notable economic data releases is:

Monday: ISM manufacturing report

Tuesday: ISM services report / Job Openings and Labor Turnover Survey / decision of the Reserve Bank of Australia

Wednesday: ADP employment report

Thursday: Initial jobless claims reading / decisions of the European Central Bank and the Bank of England

Friday: Monthly US jobs report / the consumer credit report / a preliminary reading of consumer confidence for February.

Closing Thoughts

The popular narrative that artificial intelligence is the engine keeping the U.S. economy alive appears to be overstated, according to recent analyses.

The AI boom has reshaped market valuations, driven large investments and record bond issuance to finance data centers, and heavily influenced gross domestic product, or GDP, especially in early 2025. This led many economists and market participants to suggest AI investment was the savior of an otherwise-stagnant domestic economy.

However, a January report from MRB Partners reveals that consumption was the most crucial driver of US GDP growth last year, which is usually the case in periods of economic expansion. AI-related capital expenditures were the second-biggest driver.

While AI is an important part of the growth story, it's not the only part of the growth story. A popular narrative is that if we didn't have the AI capex, GDP would have slumped last year. However, the numbers say otherwise. It's the U.S. consumer that continues to drive the expansion.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.