Risk Is On Again

October 27, 2025

Market Roundup for the Week

The U.S. trading markets for the week of October 20th through October 24th, 2025, were characterized by volatility that ultimately resolved into weekly gains for the major indices, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closing at or near record highs.

Optimism about earnings might have been a key driver. A number of companies reported solid earnings, with early Q3 results showing stronger-than-expected profits. For example, an estimated 84% of initial reporters beat expectations.

Inflation data (CPI) came in slightly softer than expected (~3% vs ~3.1%), which boosted hopes that the Federal Reserve may cut interest rates, adding fuel to the rally.

Market confidence appeared to be restored after earlier worries about regional banks and credit issues lessened during the week.

Despite the rally, headwinds remain – ongoing government shutdown in the U.S., trade-tension with China (e.g., rare-earth exports), and weaker oil/commodities remain in the backdrop.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

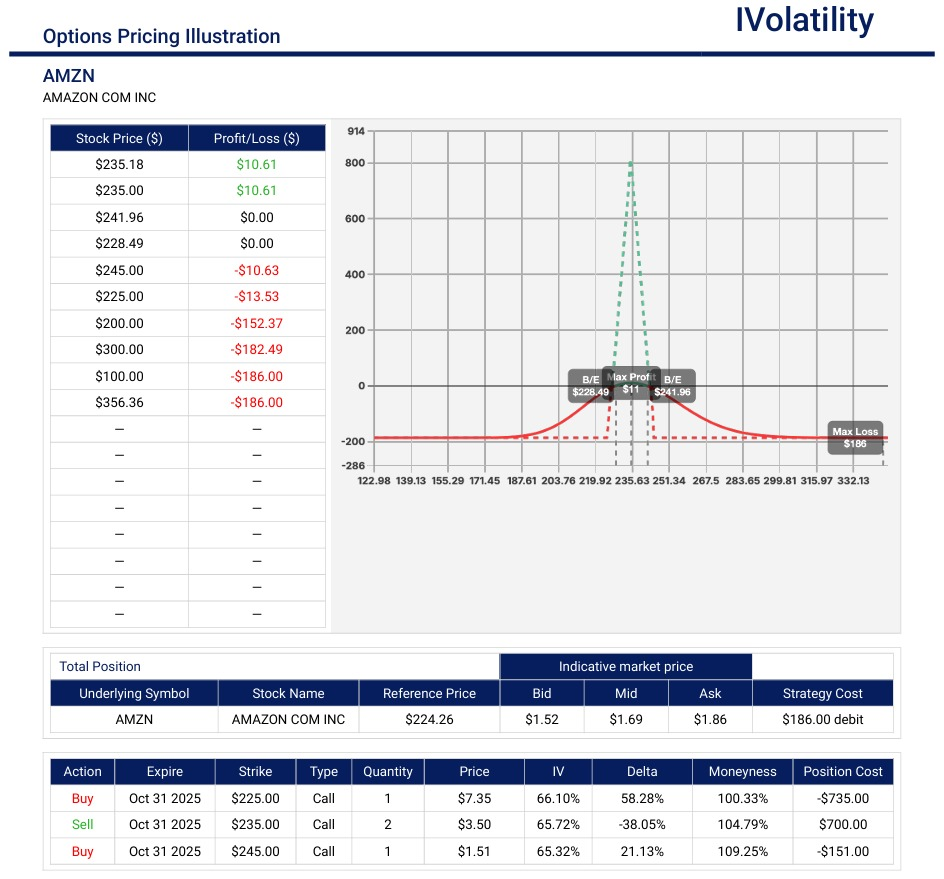

- AMZN (closed around 224 on Friday, Oct 24th)

AMZN is releasing earnings on Oct 30th. If an investor is bullish for earnings, a skewed call butterfly could be a profitable strategy.

Buy one Oct31 225 call / Sell two Oct31 235 calls / Buy one Oct31 245 call

Debit paid about $170 and that is the maximum risk in the trade

If AMZN expires at 245, Max potential profit of $1170

If AMZN expires above 245, Max potential profit of $670

PnL Calculator from the IVolLive Web - NFLX (closed around 1095 on Friday, Oct 25th)

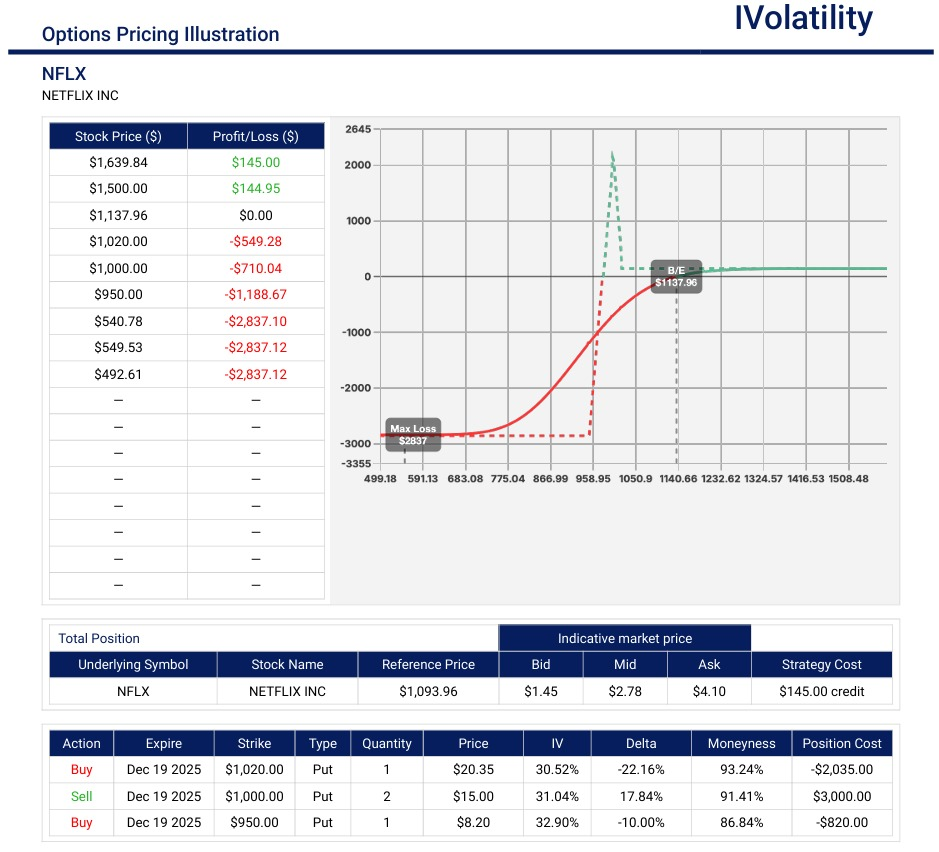

The company's earnings were not received well and it has continued to slide downward since then. If an investor sees some support at these levels, a put broken wing butterfly could be considered.

Buy one Dec19 1020 put / Sell two Dec19 1000 puts / Buy one Dec19 950 put

Credit collected about $300 / Buying power around $2700

No risk to the upside / downside breakeven around 980

Sweet spot is if NFLX expires around 1000 when an additional potential profit of $2000 can be harvested

PnL Calculator from the IVolLive Web

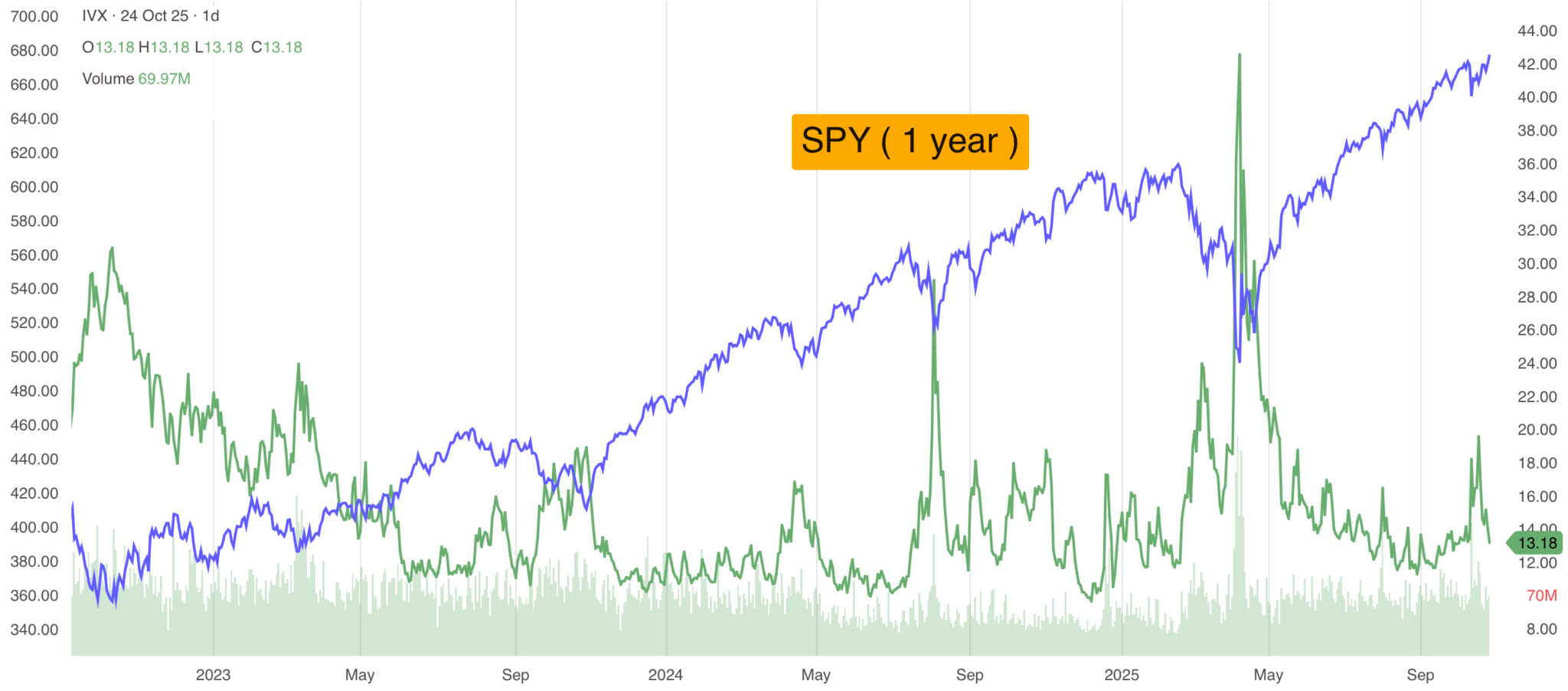

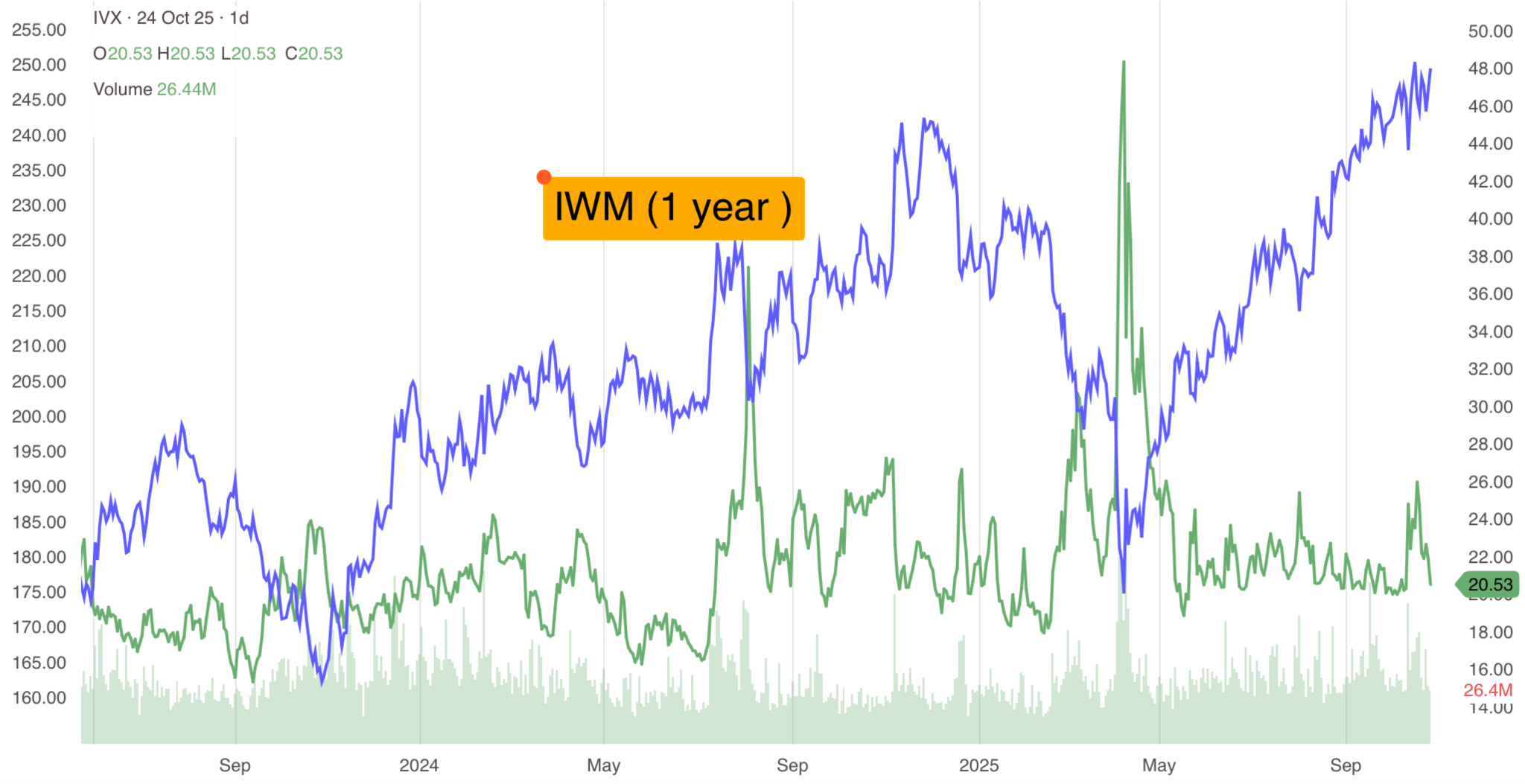

Movement of the Major Indeces:

These numbers are reporting the tradable activity from the opening on Monday to the closing on Friday (any gaps over the weekend are not included).

| INDEX | UP | DOWN |

| SPY | 1.94% | |

| QQQ | 2.14% | |

| IWM | 2.47% | |

| DIA | 2.27% | |

| GLD | -2.87%> | |

| BTC/USD | 4.25% | |

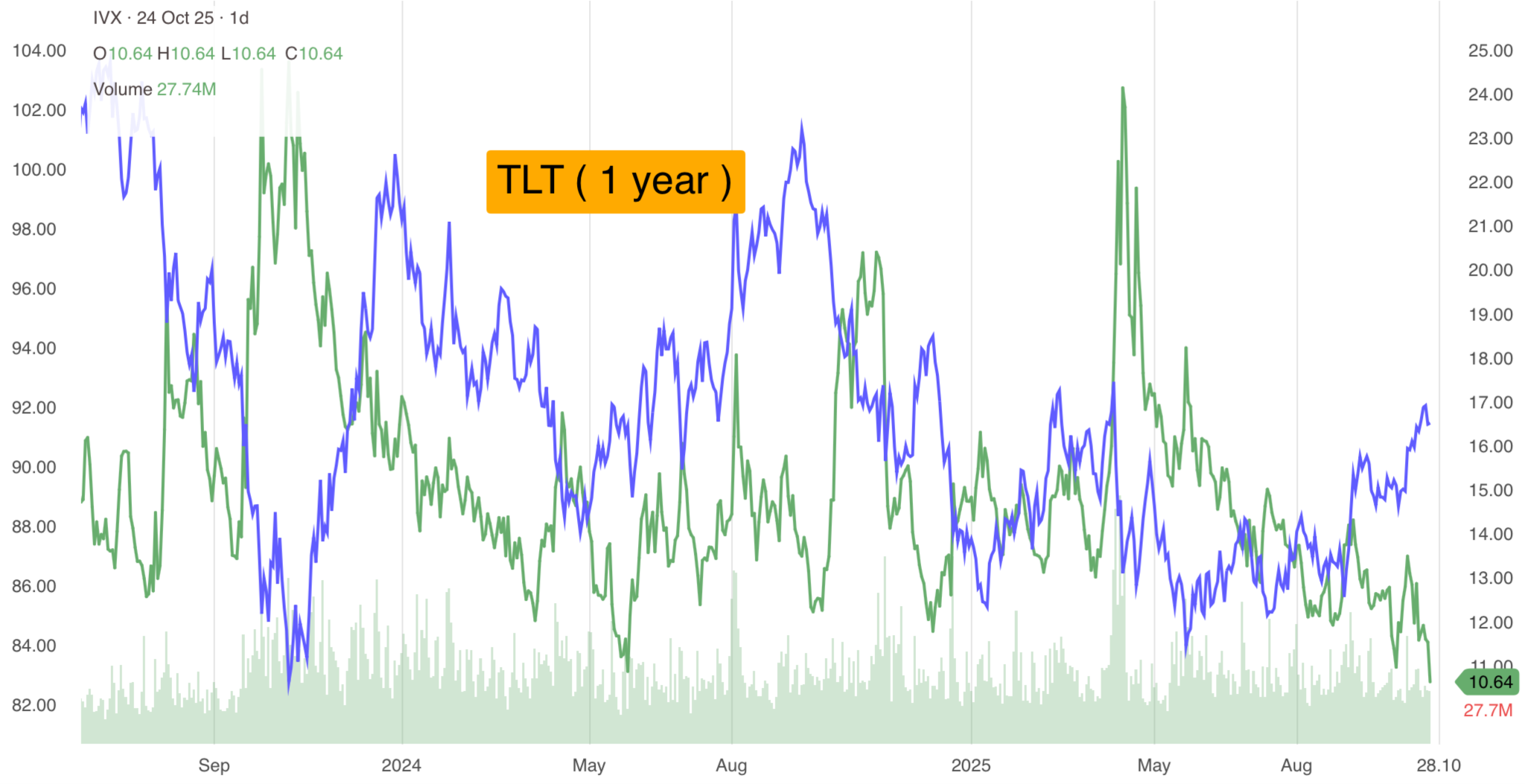

| TLT | .3% | |

| Crude Oil | 6.88% | |

| VIX | -21.25% |

Movement of the Major Sectors:

| INDEX | UP | DOWN |

| XLK | 2.59% | |

| XLF | 1.56% | |

| XLV | 1.00% | |

| XLY | 1.91% | |

| XLI | 2.02% | |

| XLP | .87% | |

| XLE | -.89% | |

| XLU | .77% | |

| XLB | 1.51% | |

| XLRE | -0.07% |

Notable S&P gainers for the week of Oct 20th-24th:

The largest percentage gainers were often companies with strong quarterly results or favorable industry news. Key performers among the larger and more frequently tracked stocks included:

Comfort Systems (FIX) rose nearly 19% following a strong earnings report and larger than expected backlog.

Ford Motor (F) rose around 12% after posting third-quarter earnings that beat analysts' estimates.

General Motors (GM) shot up approximately 15% following strong third-quarter results and a healthy uptick in domestic vehicle sales.

International Business Machines (IBM) jumped nearly 8% mostly due to a report that it could run a key quantum computing algorithm on a readily available Advanced Micro Devices (AMD) chip.

Advanced Micro Devices (AMD) surged nearly 8% following the positive news related to the IBM quantum computing report.

Micron (MU) rose around 6% benefitting from the AMD and IBM news.

Notable S&P losers for the week of Oct 20th - 24th:

STMicroelectronics (STM) fell nearly 15% for the week primarily driven by a weaker-than-expected revenue outlook for the fourth quarter and the full year, despite the company reporting better-than-expected financial results for the third quarter.

Sonic Automotive (SAH) declined over 14% for the week primarily due to missed earnings and challenges due to increases in medical expenses.

Deckers Outdoor (DECK) dropped approximately nearly 13% for the week. The drop was a reaction to the Ugg and Hoka shoemaker's weaker-than-expected outlook, which cited an anticipated pullback in consumer spending due to tariffs and higher prices.

Netflix (NFLX) sank over 10% after the company reported lower-than-expected net income for the third quarter. The results were hit by a one-time tax expense related to its business in Brazil.

Review selected market indices below:

Daily Notable Price Action

Monday's Markets:

Stocks started the week strong after White House economic advisor Kevin Hassett predicted that the government shutdown is "likely to end sometime this week."

10-year Treasury yields fell back below 4%, while all three major indexes rallied, with the S&P 500 enjoying its best two-day gain since June.

Gold climbed yet again, rising well above $4,300 an ounce for its 49th record close of the year, with the precious metal now up more than 68% in 2025.

Oil continued to slide and its price went into contango... i.e. crude's spot price fell below its future price.

Monday's Movers to the Upside:

- Apple (AAPL) climbed nearly 4% to its first record high of 2025, as shareholders cheered reports of strong iPhone 17 sales.

- Cleveland-Cliffs (CLF) popped nearly 22% after the steelmaker not only reported strong earnings, but also hinted that it may get into rare earth mining.

- Rare earth miners rallied after Australia offered its vast mineral reserves as a way for the US to circumvent Chinese export restrictions. USA Rare Earth (USAR) jumped nearly 14%, while Ramaco Resources (METC) gained over 4%.

- WW International (WW) added over 9% on the news that it will partner with Amazon to deliver medications, including injectable GLP-1 weight-loss drugs.

- Flying taxi maker Archer Aviation (ACHR) rallied over 6.5% thanks to a deal to provide Korean Air with up to 100 of its electric vertical takeoff and landing aircraft.

- Replimune Group (REPL) nearly doubled in price after the FDA accepted its resubmission for its skin cancer treatment.

Monday's Movers to the Downside:

- Olema Pharmaceuticals (OLMA) plummeted nearly 17% after positive results for its new breast cancer treatment failed to live up to investor expectations.

- Exelixis (EXEL) plunged 12% probably due trial results that revealed the biotech's colorectal cancer treatment had mixed results.

- AppLovin (APP) lost over 5% on reports that the mobile tech software company is in trouble again with regulators.

Tuesday's Markets:

A strong start for markets was derailed after President Trump mused that his big meeting with China's Xi Jinping may not happen. The S&P 500 and Nasdaq were muted all afternoon, but the Dow charged to its 12th new all-time high of the year.

Bitcoin has been slowly clawing its way back from last week's big selloff, and the crypto king popped nicely in the late afternoon as trader sentiment continued to recover.

Gold experienced a significant decline, which was widely reported as one of its largest single-day percentage drops in years. The sell-off was attributed to factors like a stronger US dollar, broad market profit-taking after the metal hit a fresh record high on Monday, and an easing of some geopolitical tensions.

Tuesday's Movers to the Upside:

- Beyond Meat (BYND) rose another 140% after the plant-based alternative company was added to the newly revived MEME ETF.

- Six Flags Entertainment (FUN) soared nearly 18% after Taylor Swift's fiancee Travis Kelce joined Jana Partner's activist campaign to push for substantial changes at the company.

- Fannie Mae (FNMA) rose over 9.5% while Freddie Mac (FMCC) gained over 10% after the FHFA Director teased that the two mortgage giants could go public this year.

- General Motors (GM) rallied nearly 15% thanks to a solid beat-and-raise earnings report. Shareholders hope that tariffs would not take a heavier toll.

- Coca-Cola (KO) gained over 4% after beating analyst estimates for the top and bottom lines, as well as reaffirming its full-year fiscal guidance.

- 3M (MMM) rose nearly 8% after crushing revenue forecasts, surpassing profit expectations, and raising its 2026 earnings guidance.

- Raytheon (RTX) jumped nearly 8% due to a strong quarter for the defense contractor.

Tuesday's Movers to the Downside:

- Cleveland-Cliffs (CLF) fell over 17% today after Wells Fargo analysts called Monday's rally an overreaction and downgraded the steelmaker.

- Alphabet (GOOGL) lost 2.21% after competitor OpenAI revealed an AI-powered web browser called ChatGPT Atlas.

- NuScale (SMR) stumbled over 13% on reports that construction company Fluor may be forced to sell its stake in the modular nuclear reactor company.

- Philip Morris (MO) lost nearly 4% after beating earnings estimates but failing to raise its forecast.

- Lockheed Martin (LMT) may have met Wall Street's revenue forecasts, but it fell short on profits, and shares sank 3.24%.

- Rare earth miners took a beating due to a multibillion-dollar critical minerals deal between the US and Australia. MP Materials (MP) lost over 10%, USA Rare Earth (USAR) tumbled over 15%, and Ramaco Resources (METC) sold off over 12%.

- Gold miners stumbled thanks to a selloff for the commodity. Newmont (NEM) dropped over 9%, Barrick Mining (B) fell over 9%, and Agnico Eagle Mining (AEM) sank over 8.5%.

Wednesday's Markets:

Meme stocks are so hot right now that it appears that irrational exuberance is driving the market. But reports that the Trump administration is considering new restrictions on software exports to China tamped investor greed and brought in some fear.

Oil climbed on reports that US crude demand rose last week, while traders hoped that a potential trade deal with India includes an agreement to reduce Russian oil purchases.

Wednesday's Movers to the Upside:

- The recent retail trading frenzy (see BYND) pulled former meme stock favorites Krispy Kreme (KKD) and GoPro (GPRO) 8.63% and 5% higher.

- Intuitive Surgical (ISRG) jumped nearly 14% after the surgical robot-maker crushed Wall Street estimates last quarter.

- Winnebago Industries (WGO) soared nearly 30% due to a blowout earnings report for the mobile home manufacturer.

- Western Alliance (WAL) beat analyst expectations last quarter, pushing shares higher by over 3% as the regional bank shrugged off First Brands & Tricolor bankruptcy concerns.

- Hilton Worldwide rallied 3.42% after the hotel giant posted solid earnings despite lower occupancy rates.

Wednesday's Movers to the Downside:

- Netflix (NFLX) tumbled over 10% after a tax dispute in Brazil derailed what was otherwise one of its strongest quarters ever.

- Texas Instruments (TXN) lost over 5.5% after the company posted mixed earnings and issued disappointing fourth-quarter financial guidance.

- Mattel (MAT) fell nearly 3% thanks to lower than expected North American sales.

- Oklo Inc (OKLO) plunged nearly 14% thanks to a Financial Times story detailing the nuclear power startup's complete lack of revenue, licenses, and customer contracts.

- Although AT&T (T) added far more postpaid net phone subscribers last quarter than analysts expected, shares fell nearly 2% when that didn't translate to stronger earnings.

Thursday's Markets:

Stocks rose while bond yields fell as news that President Trump and Chinese President Xi will meet next week gave investors hope of a trade war detente.

Crude enjoyed its best day in four months after the Trump administration slapped additional sanctions on the two largest oil companies in Russia.

The entire crypto market got a boost after Trump pardoned Binance founder Changpeng Zhao, who was convicted for money laundering in 2023.

Thursday's Movers to the Upside:

- Palantir (PLTR) added nearly 3% on the news that it will partner with Lumen Technologies to create enterprise AI services.

- Honeywell International (HON) gained nearly 7% thanks to better-than-expected earnings.

- Dow Inc. (DOW) posted a significantly narrower earnings loss and shares rose nearly 13% hoping effective cost management is producing good results.

- American Airlines (AAL) rose over 5.5% higher after reporting a smaller-than-expected profit loss and raising its full-year fiscal guidance.

- Las Vegas Sands (LVS) jumped over 12% thanks to a 24% year over year increase in revenue due in part to a great quarter at its Singapore and Macau properties.

- West Pharmaceutical Services (WST) popped 11% due to a solid beat-and-raise earnings report.

Thursday's Movers to the Downside:

- Super Micro Computer (SMCI) sank nearly 9% after the company cut its fiscal first quarter revenue forecast from $6-$7 billion down to $5 billion.

- Southwest Airlines (LUV) may have reported record Q3 profits and revenue, but shares still fell 6.25% perhaps due to pessimism regarding the company's trajectory and profitability in the future.

- T-Mobile (TMUS) added a record 2.3 million postpaid net customers, but investors were unimpressed, and shares dropped over 3%.

- Molina Healthcare (MOH) lost over 17% after the insurer cut its full-year earnings outlook for the third time in a row.

- Moderna (MRNA) fell over 2% after it halted the development of a vaccine designed to prevent birth defects caused by cytomegalovirus.

Friday's Markets:

Mild inflation data pushed stocks higher today. All three major indexes hit new record closing highs, while the Dow closed above 47,000 and the S&P 500 briefly broke above 6,800 for the first time ever.

But despite Wall Street's exuberance, inflation still remains stubbornly above the Fed's 2% target.

The Trump administration launched a probe into whether or not China complied with a limited trade agreement from 2020, raising tensions ahead of a pivotal trade meeting between the US and China next week.

Crude sold off today, though it cemented a weekly gain thanks to new US sanctions on Russia. Gold fell as well, capping off a weekly loss and ending its nine-week winning streak.

Friday's Movers to the Upside:

- Power stocks were pushed higher after US Energy Secretary Chris Wright urged the Federal Energy Regulatory Commission to cut data-center grid connection reviews from several years to a max of 60 days. That resulted in AI energy players like Oklo to jump over 9% and ConstellationEnergy (CEG) to jump over 6%.

- Alphabet (GOOGL) climbed nearly 3% on the news that AI startup Anthropic will use up to 1 million Alphabet chips as part of a multibillion-dollar deal.

- Ford (F) flew up over 12% higher after investors were willing to overlook a lower fiscal forecast in lieu of a fantastic third quarter.

- Advanced Micro Devices (AMD) got a quantum boost from IBM, which announced that it can use AMD chips to run a quantum computing error correction algorithm. Both AMD and IBM rose up nearly 8%.

- Boston Beer (SAM) bounced 5.45% after the beverage maker posted lower revenue last quarter, but pushed its full-year fiscal forecast higher, noting that tariff costs will be manageable.

Friday's Movers to the Downside:

- Booz Allen Hamilton (BAH) stumbled nearly 9% after the government consulting firm cut its fiscal forecast, noting that the ongoing shutdown will eat into its profits.

- An IT outage grounded Alaska Air Group (ALK) flights for several hours, pushing shares down over 6%.

- Deckers Outdoor (DECK) plummeted over 15% after the parent company of Hoka and Uggs revealed weaker-than-expected fiscal guidance due to tariffs.

- An excellent year for gold translated to strong earnings for Newmont Mining (NEM), but the miner still sank over 6%, probably due to shareholders taking profits.

- Beyond Meat (BYND) fell over 23% after the alternative meat maker announced it will take a noncash impairment charge the size of which management was unable to confirm.

Notable Economic Data due week of Oct 27th - 31st:

The most significant economic event expected in the coming week is the U.S. Federal Reserve's Federal Open Market Committee (FOMC) meeting and Interest Rate Decision on Wednesday, October 29.

In addition to the central bank action, other major data releases generally scheduled for this week include:

- U.S. Durable Goods Orders (Monday, October 27)

- U.S. Consumer Confidence (Tuesday, October 28)

- U.S. Advance Q3 GDP (Thursday, October 30)

- U.S. Personal Income and Spending, including PCE Price Index (Friday, October 31)

Please note that the ongoing federal government shutdown which began on October 1st, 2025 has resulted in cancellation of some (or all) economic reports. Consequently, traders should expect a "data blackout" or significant delays for all the official government statistics (Durable Goods, GDP, PCE).

The Fed decision and the US GDP report are highly anticipated by markets and may significantly influence financial and economic outlooks.

Notable Earnings due week of Oct 27th - 31st:

The actual day may vary, so do consult with your broker to confirm the actual date.

With economic data releases dried up because of the government shutdown, investors will focus on earnings reports. The coming week, beginning Monday, October 27th, 2025, is arguably the most important week of the entire earnings season, as it features reports from the bulk of the U.S. mega-cap technology companies, often referred to as the "Magnificent Seven" (or Mag7).

The AI trade has become quite frothy, so traders will be closely scrutinizing every financial metric these companies report. Five of the seven Mag 7 stocks are trading at forward price-to-earnings valuations above their five-year averages, with the exceptions being Amazon and Nvidia, according to Barron's.

For AI favorites like Meta, Alphabet, Amazon and Microsoft, Wall Street will be hoping for monetization of the technology to prove that big tech companies aren't doling out hundreds of billions on data centers without signs of future profits. The market's performance and future narrative will largely be set by the results and outlooks from these influential companies.

Monday: PFG / WM / NUE / CAR

Tuesday: UNH / V / STX / UPS / DHI / PYPL / AMT / SOFI / BKNG / MDLZ / RCL

Wednesday: GOOGL / MSFT / META / SBUX / TDOC / CAT / ETSY/ BA / VZ / NOW

Thursday: AAPL / AMZN / MRK / MA / LLY / BMY / TMUS / UNP / HON / COIN

Friday: XOM / CVS / ABBV / CL

Closing Thoughts

Just a few months ago, investor focus was simply on tariffs. But the S&P has soared 35% after plummeting the week after Liberation Day to a low on April 8. This rally has pushed tariff fears out of investors' minds, while a global trade war hasn't had nearly the devastating effect on the US economy that analysts predicted.

But a pair of reports late last week made it clear that even though Americans have moved past tariffs, high levies are still going to take a big bite out of their wallets.

Recently Goldman Sachs Chief Economist Jan Hatzius wrote that his team had analyzed imports, customs duties, and consumer prices to figure out who is paying the biggest price for these new tariffs. Turns out, the average US citizen is footing over half of the trade war bill.

"Our analysis implies that if recently implemented and future tariffs have the same eventual impact on prices as the tariffs implemented earlier this year, then US consumers would eventually absorb 55% of tariff costs, US businesses would absorb 22%, foreign exporters would absorb 18%, and 5% would be evaded", Hatzius wrote. "At the moment, however, US businesses are likely bearing a larger share of the costs because some tariffs have just gone into effect and it takes time to raise prices on consumers and negotiate lower import prices with foreign suppliers."

Hatzius isn't the only one warning that Americans will see prices rise this year. A white paper from S&P Global noted that the company pored over forecasts from 15,000 sell-side analysts across 9,000 public companies and found that tariffs will cost companies over $1.2 trillion in lost profits.

Of course, companies aren't going to stand idly by and eat all those losses. "Roughly two-thirds ($592 billion) of the incremental cost burden is being passed to consumers via higher prices, while one-third ($315 billion) is absorbed internally through lower earnings", the report read. "With real output declining, consumers are paying more for less, suggesting that this two-thirds share represents a lower bound on their true burden."

While tariffed goods will naturally get more expensive, higher prices for some items will translate to higher inflation for all. Hatzius warned that tariffs have raised core personal consumption expenditure prices by 0.44% this year, and will push core PCE to 3% year over year by December.

And it's not just big, publicly traded companies taking a hit from higher tariffs: Small companies that aren't able to pass higher costs on to customers are eating the increased expenses, putting them at risk of bankruptcy.

Basically, tariffs are still going to do serious damage to the economy, even if they're not front page news these days.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.