All Quiet on the Market Front

July 14, 2025

Market Roundup for the Week

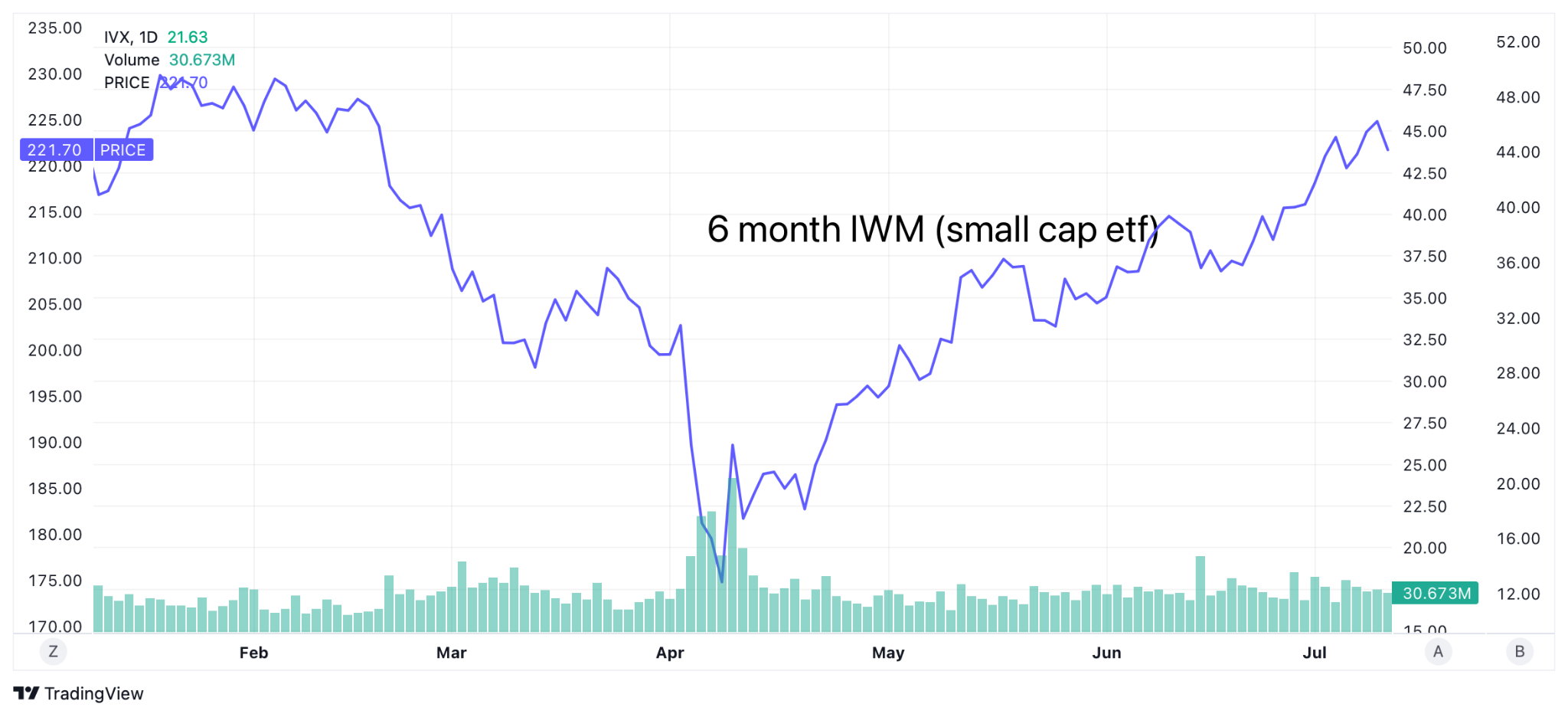

The S&P 500 reached $6,300, hitting new all-time highs and surpassed its previous high set in February. The speed of recovery is probably one of the quickest in recent history.

This rally ranks as the third-fastest rebound from a market bottom, trailing only the 2009 financial crisis recovery and 2020's pandemic rebound. While smaller in magnitude than the historical median of 31% over 206 days, its speed places it among notable recoveries in market history.

Three important characteristics of this recovery might be pointed out here:

- Fairly smooth with minor interruptions

- Normalization of the VIX indicates a restoration of investor confidence

- It does not appear to be "finished" yet

Despite President Trump threatening a whole new set of tariffs this week, investors stayed calm. The S&P 500 and Nasdaq notched a record on Thursday, the king of the stock market, Nvidia, became the first public company to reach a $4 trillion market cap, big names on the Street are upping their price targets, and volatility is way down. This is markedly different from investor reaction following Liberation Day on April 2, when traders wiped out nearly $6 trillion in market value in just two days.

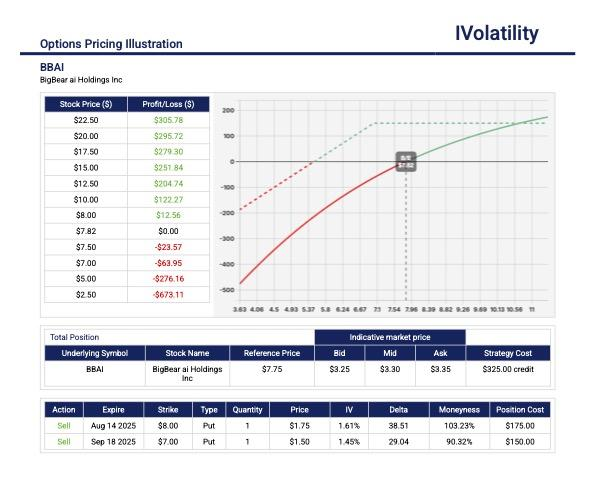

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

- FCX (closed at 46.33 on Friday)

With copper in play due to AI-related uses and now tariffs, one might consider getting bullish with this major copper producer

Strategy: Call diagonal (since IVR is quite low)

Buy the Nov21 43call / Sell the Aug15 50call

Net position delta = 38 / Debit paid = $527

There are many weeks in between to roll the short call and reduce cost.

Max potential value over $700

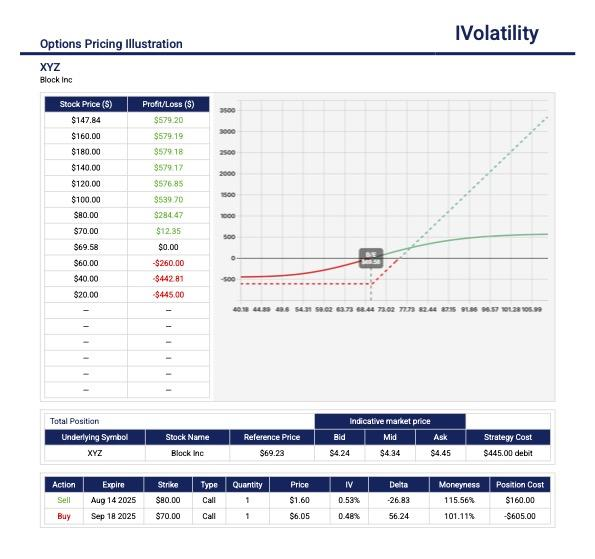

PnL Calculator from the IVolLive Web - NFLX (closed at 1245 on Friday)

With earnings on the horizon and a couple of days of correction after a long move upwards, one might consider getting bullish for the week of earnings.

Strategy: Put broken wing butterfly

Buy one July 1200put / Sell two July 1170puts / Buy one July 1100put

Net position delta = 6.5 / Premium collected = $300

Buying power = $3700 / Probability of profit = 87%

Max potential profit: $3300 No risk to the upside / downside breakeven around 1137

PnL Calculator from the IVolLive Web

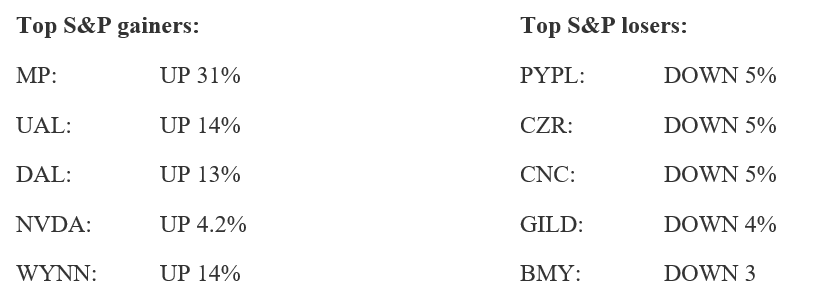

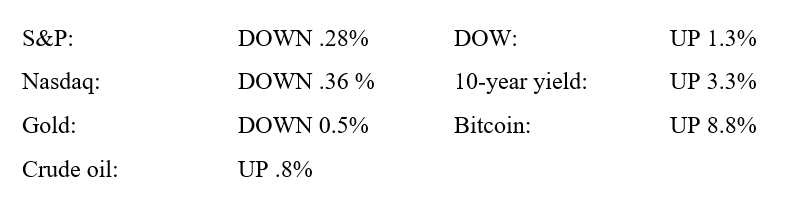

Major Indices for week ending 7/11/2025

Review selected market profiles below:

Top Headlines Each Day of the Week

Monday's Recap:

US equities tumbled from record highs, dragged down by megacaps, as President Trump reignited the dormant trade war with fresh tariff warnings against major trading partners. In a series of Truth Social posts, Trump shared screenshots of signed letters to leaders of various countries showing the new tariffs to be imposed.

Oil gained despite OPEC+ deciding to raise crude production by 548,000 barrels per day beginning in August, a larger-than-expected increase. Ultimately, Wall Street analysts expect oil futures to drop below $60 a barrel by the end of the year due to the increase in production.

It now appears that the tariff rates will start on August 1st.

The materials, metals and mining sectors have displayed a great deal of sensitivity around tariff headlines since April, and today's price action was the same as before. Traders drove up the price of precious metals, including copper.

Notable movers to the upside:

- WNS Holdings, an IT outsourcing firm, jumped over 14% after a French consulting company agreed to purchase it

- Uber climbed over 3% and hit a record high after Wells Fargo raised its price target from $100 to $120

- Amplify, a Cybersecurity ETF notching a new all-time high

- Geo Group and CoreCivic, two private prison companies, gained over 4% due to Trump's tax bill that promises to boost funding for immigration detention centers

- HOOD popped over 10% based on its announcement that a group has new crypto-related offerings and tokenized US stocks and etfs and crypto-staking

Notable movers to the downside:

- Tesla tumbled 6.79% after CEO Elon Musk announced the creation of a new political party, the America Party. This is not quite the direction that TSLA investors would like Musk to take given his need at the help of TSLA

- Toyota and Honda dropped nearly 4% a piece following Trump's tariff threats against Japan

- BitMine Immersion Technologies got over a 20% haircut after surging 3,000% in the five trading days ending July 3. It appears to be modeling its business after MSTR by buying $250 million worth of Ethereum

Tuesday:

Investors mostly yawned and the major indexes held steady a day after President Trump reignited his trade war by announcing higher tariffs would go into effect on 14 countries starting Aug. 1. Wall Street banks don't seem concerned either, as Goldman Sachs and Bank of America became the latest strategists to raise their year-end target for the S&P 500.

Copper futures popped as much as 17% to a new record, the largest intraday gain since 1988, after Trump said he plans to place a 50% tariff on copper imports.

Notable movers to the upside:

- Tesla recovered over 1% from Monday's drop

- Lucid, a high-end Tesla rival, popped over 8% after setting the Guinness World Record for the longest journey by an electric car on a single charge: about 749 miles

- EssilorLuxottica, the world's largest eyewear maker and maker of Ray-Ban, jumped over 6% after Meta reportedly acquired a stake in the company

- Sequans Communications soared 44.06% after the French semiconductor company said it raised $384 million to start purchasing – you guessed it – bitcoin

- BTCS Inc., a crypto company, jumped over 100% after it announced a plan to to raise $100 million to purchase ethereum (MSTR model?)

Notable movers to the downside:

- Clean energy stocks like SunRun, Enphase Energy and First Solar dropped after President Trump directed federal agencies to cancel subsidies to wind and solar companies

- Hershey shares dropped apparently upon the announcement of a new CEO

- Datadog, the software company that was recently tapped to join the S&P 500 index, slumped over 4% after being downgraded by Guggenheim Securities

- Fair Isaac Corp. (FICO) sank almost 9% when the Federal Housing Finance Agency said it would begin accepting rival credit score VantageScore 4.0 for mortgages sold to Fannie Mae and Freddie Mac, heating up competition for the longtime leader in the space

Wednesday:

The major indexes plowed higher with the minutes of the last FOMC meeting showing that officials were not at all united about when to begin cutting rates. Investors also learned about more tariff letters sent by President Trump to seven additional countries including Iraq and the Philippines.

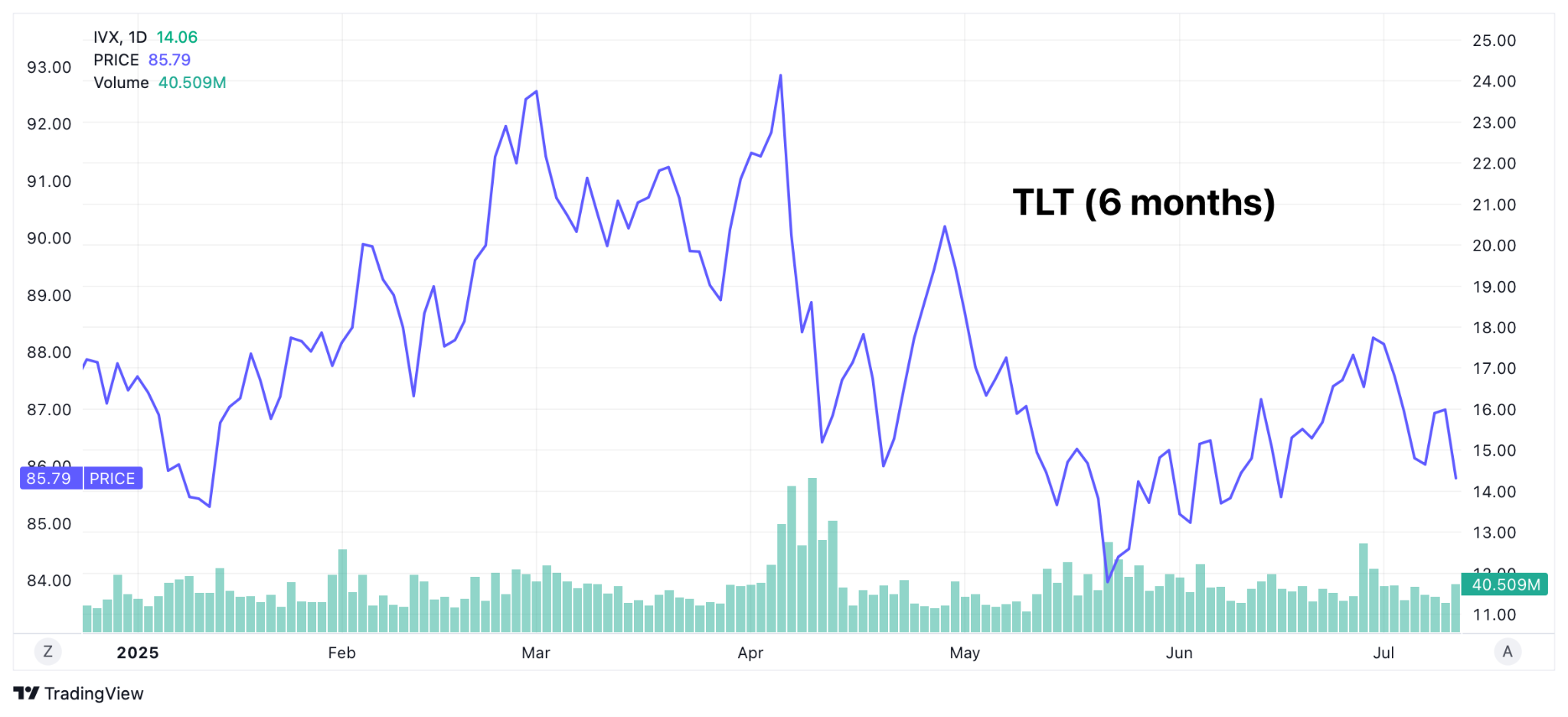

Treasuries snapped a five-day losing streak after a $39 billion sale of 1-year notes was met with solid demand.

History was made today when NVDA became the first US company to reach a $4 trillion market cap. Founded in 1993, it reached $1 trillion in 2023, over $3 trillion by mid-2024 and $4 trillion today.

Notable movers to the upside:

- NVDA hit the $4 trillion market cap

- Kellogg popped over 30% after Italian chocolate giant Ferrero agreed to acquire it

- Tesla continued to rebound from its plunge on Monday. Elon Musk said that Tesla's robotaxi service would expand into the Bay Area "probably in a month or two" and that his AI chatbot Grok is coming to Tesla vehicles by next week

- Estée Lauder gained over 6% after Bank of America slapped a buy rating on the stock

- ProKidney continued its remarkable rally, rising another 19.35%, after the biotech announced positive trial results for its diabetes treatment. It's gone from a penny stock to a $1.55 billion market cap in the past four days

- Copper companies Freeport-McMoRan and Southern Copper gained on account of Trump's increased tariffs on copper

- Hims & Hers Health gained nearly 5% after announcing it will sell generic versions when Novo Nordisk's patents for Ozempic and Wegovy expire

- Rhythm Pharmaceuticals popped over 36% thanks to a promising new trial for its obesity treatment

Notable movers to the downside:

- WPP cut its guidance and the stock fell nearly 20%

- T-Mobile ticked lower after getting a downgrade from KeyBanc. It is reported that a weakness in fiber internet would make it difficult to compete with AT&T

- Mobileye, maker of self-driving technology (spun from Intel) fell over 7% when Intel said it was selling 45 million shares

Thursday:

Everything that could have gone right on Wall Street did, with jobless claims coming in lower than expected, the 30-year bond auction being met with strong demand, and Delta unofficially kicking off earnings season with a solid report. The S&P 500 and the Nasdaq hit record highs.

Stocks were fully in rally mode, notching fresh record highs by focusing more on Delta than on the trade war. For the market, this is turning into a new normal. Just in time for earnings season.

Bitcoin reached a high for the second day in a row, hitting $113,863.31 today. Bitcoin price has stayed above $100k for 60 consecutive days.

Notable movers to the upside:

- Delta Airlines rose over 13% after the airline reported positive numbers and renewed full-year guidance

- Advanced Micro Devices rose over 4% after HSBC upgraded the stock to buy and set a $200 price target

- ProKidney continued its remarkable rally, rising another 19.35%, after the biotech announced positive trial results for its diabetes treatment. It's gone from a penny stock to a $1.55 billion market cap in the past four days

Notable movers to the downside:

- Biotech partners Ultragenyx and Mereo BioPharma Group seriously plunged after issuing a disappointing update on their trial of a treatment for a rare genetic bone condition

- Vertiv, the maker of liquid cooling equipment, declined nearly 6% when Amazon said it was rolling out a new liquid cooling system for its AI servers

- Hydro Flask owner Helen of Troy tumbled over 20% after reporting a large loss in its fiscal first quarter. Tariffs are apparently causing their problems

Friday:

Today the market action depicted a lazy summer's Friday – the major indexes languished all day and then finally pulled back on the close.

Bitcoin hit a new high-water mark above $118,000 as more institutional investors and corporations scooped up the crypto.

Silver rose to its highest level since 2011, and appears to be hotter than gold recently. The metal is up over 25% this year. Oil, meanwhile, ticked higher on speculation that President Trump will place more sanctions on Russia early next week.

Notable movers to the upside:

- LEVI soared over 11% on Friday after the retailer announced Q2 sales that were 6% higher than a year earlier and well above Wall Street's expectations

- Kraft Heinz jumped 2.5% following a WSJ report it was preparing to break itself up

- Companies in the drone sector rose after the Pentagon introduced measures to supercharge production and deployment. Red Cat rose nearly 30%, AeroVironment and Kratos Defense & Security Solutions rose over 10%

- Performance Food Group jumped nearly 5% to a record after reportedly being eyed by US Foods Holding for a takeover. A combined company would become the largest foodservice distributor in the US

- AMC Entertainment popped 11% on an upgrade from Wedbush

Notable movers to the downside:

- Delta and United took a breather after their big celebration on Thursday post-Delta earnings

- Penn Entertainment dropped nearly 8% when gaming revenue for Iowa and Indiana came in soft

- Sunrun's up-and-down week ended...down, with the solar stock falling 7%

Considerations for the coming week

Earnings Reports:

Earnings season is upon us again and some notables that provide opportunities for trades are listed below.

Tuesday: JPMorgan, BlackRock, Citigroup, Wells Fargo, Albertsons, and JB Hunt.

Wednesday: Goldman Sachs, Bank of America, Morgan Stanley, Johnson & Johnson, ASML, Progressive, T-Mobile, United Airlines, Discover Financial Services, and Alcoa.

Thursday: PepsiCo, Netflix, Abbott Laboratories, Cintas, US Bancorp, Travelers, Citizens Bank, Fifth Third Bancorp, and Interactive Brokers.

Friday: American Express, Charles Schwab, 3M, Unilever, Schlumberger, Ally Financial, and Trump Media & Technology Group.

Closing Thoughts

Mark Zuckerberg reportedly offered a pay package worth more than $200 million for Apple star engineer Ruoming Pang. When AAPL did not follow up with a match, Pang switched teams.

Zuck has launched an aggressive recruiting drive to form a "superintelligence" team, poaching top AI talent from rivals with compensation offers that have stunned Silicon Valley.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.