Markets Defensive Again?

May 12, 2025

The Markets at a Glance

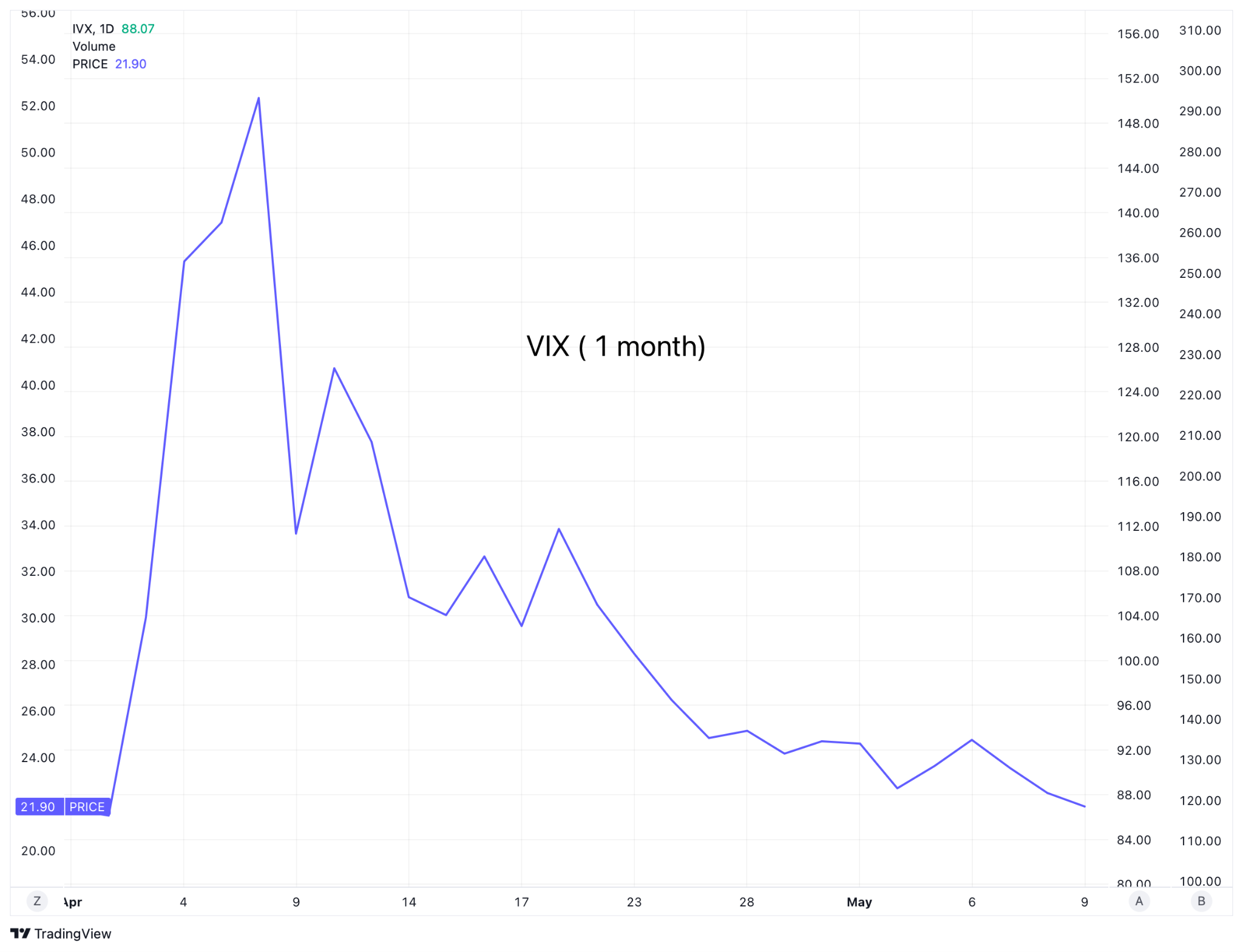

Another weekend of chaotic tariff headlines put the Capital Markets in a defensive posture at the start of the week.

The S&P started the week by ending a nine-day winning streak, the longest since 2004. Not unexpected, investors were monitoring developments on the global trade front and remained uncertain about the timeline of any trade war agreements.

Wall Street looked ahead to the Federal Reserve's two-day policy meeting beginning on Tuesday, with a rate decision expected Wednesday. According to the CME group's FedWatch tool, Fed funds futures trading pointed to just a 4.4% chance of a rate cut. Still, traders listened keenly for any words from the central bank.

Since March, the Federal Reserve has acknowledged signs of economic stress from businesses and consumer confidence surveys amid the roughshod rollout of the US administration's trade agenda. However, they appear to be resisting rate cuts with fears of unleashing inflation.

Trade war fears were back in focus this week after the US administration announced tariffs on movies made outside of the United States.

A lot of sound and fury, signifying nothing? From Monday's open to Friday's close, despite a considerable amount of chop intra-week, the major indices ended up but only slightly.

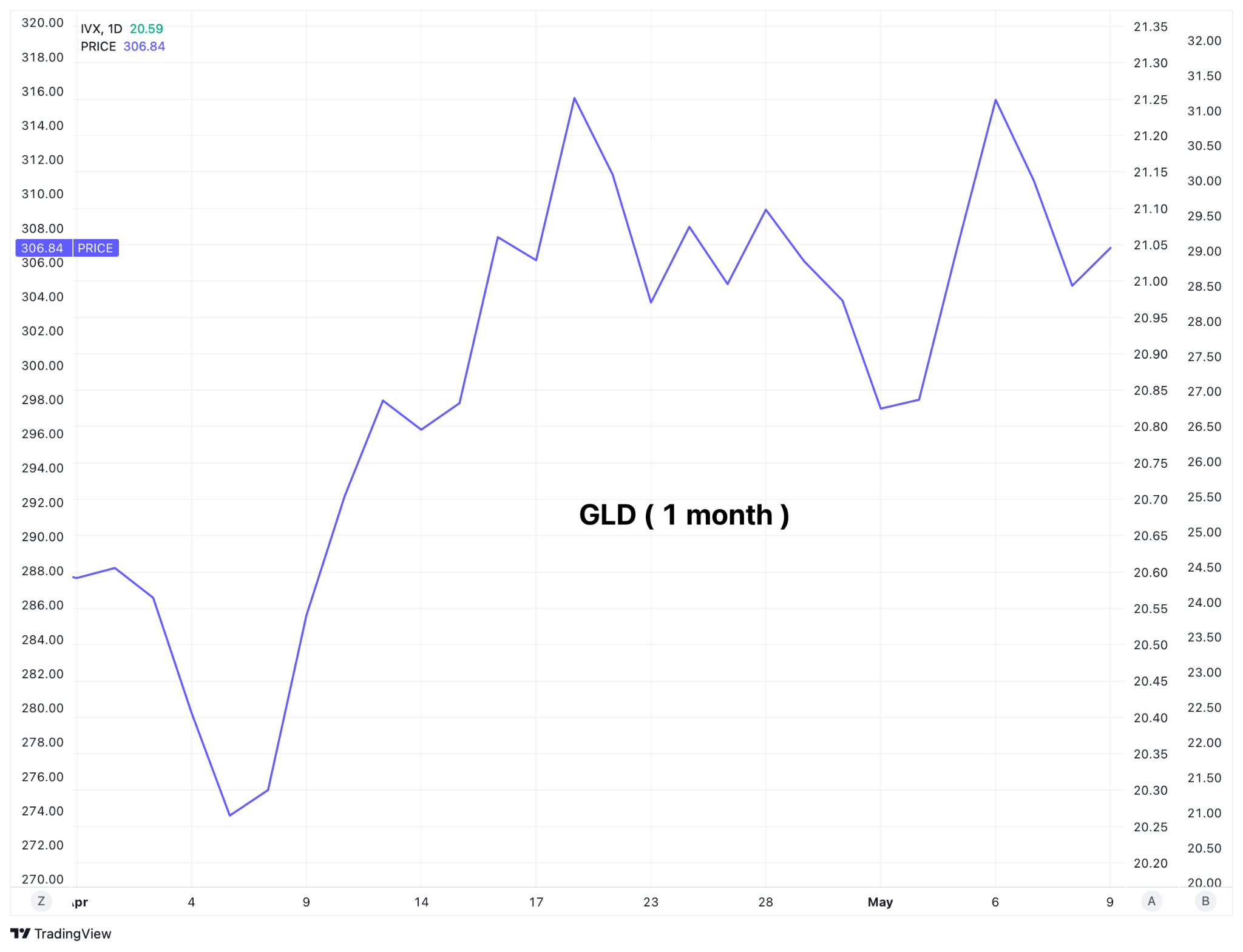

Gold, oil and bitcoin had the biggest upward moves and volatility continued to collapse.

- The S&P 500 and Nasdaq 100 have recovered over half of their losses since mid-February; will the markets make another run for the recent high around 5800 or even higher?

- Earnings season is essentially over, at least for companies that are perceived to move the markets.

- Bonds and the dollar are still wobbly.

- PMI data points to a slowdown in US growth, threatening global growth as well.

- Probability of interest rate cuts by the Federal Reserve are low for the foreseeable future.

Selected Market Profiles Are Presented Below:

Daily Recap

Monday: On Sunday evening, President Trump proposed a 100% tariff on movies not only shot outside the United States but also produced abroad. "WE WANT MOVIES MADE IN AMERICA, AGAIN!" the president declared via Truth Social. He called efforts to produce movies abroad, a "national threat".

Media stocks like NFLX, Warner Bros and IMAX (among others) endured big drops but, interestingly, analysts refrained from downgrading these stocks.

Major indices experienced a down move though the day's volume was low relative to an average value. Gold moved up in a big way; about a week's worth of expected move in one day!

94-year old Warren Buffett announced his retirement by year's end and name a 62-year old successor, Greg Abel, from within Berkshire Hathaway.

Volatility stayed bid.

Tuesday: The stock market wavered as the US administration walked back on earlier promises that trade deals were "imminent". Gold continued to trade upwards as fears of the US trade war and less confidence in stock values remain on the minds of traders.

Wednesday: The news was out that the US Treasury Secretary and his team met with their Chinese counterparts in Switzerland to discuss the tariffs. Though stocks rebounded higher at the start of the day, the rally evaporated after the Federal Reserve Governor Jerome Powell declared that the central bank will not be making any hasty moves to lower interest rates. "My gut tells me that uncertainty for the path of the economy is extremely elevated", Powell explained.

So interest rates remain where they have been since December 2024.

Disney beat earnings expectations and soared up almost 11%. The company also announced plans to build its 7th international theme park in Abu Dhabi, its first venture into the Middle East.

Although UBER's earnings did not meet analyst expectations, the company revealed partnership with several robotaxi companies. The CEO announced that autonomous vehicle technology is "the single greatest opportunity" ahead for UBER.

The markets ended up, gold took a breather, but bitcoin continued its march upward.

Thursday: The US administration announced a trade deal with UK and this announcement was seen as potentially leading to successful negotiations with China as well. Markets seemed to have renewed optimism that the on-going trade war may be almost over. The risk-on attitude pushed markets so high that the losses of the entire week were erased. Small-cap stocks led the advance, with the Russell 2000 jumping 1.9%. The Dow Jones Industrial Average also posted a 0.6% gain.

Crude oil prices climbed higher and gold took another breather.

It might be noted that some economists are skeptical about the deal with the UK calling it a "photo op, with little macroeconomic significance". After all, the UK only accounts for 3% of US trade.

On the other hand, the US president was very positive about more good news ahead. He declared "you better go out and buy stock now".

As an aside, bitcoin rose above $100,000, a value that it last marked in February. Kim Kardashian is now a billionaire, and as she once tweeted, "Not bad for a girl with no talent". With the market cap of bitcoin approaching $2 trillion, a noted analyst commented "that is not bad for money that's not money."

Friday: Investors pushed the markets higher at the beginning of the day, but optimism seemed to die down and the rally quickly faded. The Capital Markets ended flat to slightly down for the week. Gold appeared to have stabilized above 3300 but oil prices continued upwards, apparently getting a tailwind from fresh U.S. sanctions on a Chinese refinery for buying oil from Iran.

Strategies to Consider

- SPY Put Diagonal

Buy the July 560put (ATM) / Sell the June 545 put (30 delta)

delta: -15

cost: $840

potential max value of around $1500

There may be several opportunities to buy back and resell a 30 delta put in the weeks intervening to reduce the cost of this trade. - AAPL call diagonal

Buy the July 195 call (ATM) / Sell the June 210 call (30 delta)

delta: 27

cost: $960

potential max value of around $1500

There may be several opportunities to buy back and resell a 30 delta call in the weeks intervening to reduce the cost of this trade. - MSTR iron condor

Sell the 280/320/600/640 iron condor delta: leaning slightly positive

premium collected: $600

buying power withheld: $3400

probability of profit: 70%

probability of 50% profit: 90%

Considerations for the Coming Weeks

CPI and PPI data is due on Tuesday and Thursday.

AMAT, CSCO, WMT and BABA may be the only significant earnings reports due.

Wall Street's biggest bulls continue to believe that the S&P 500 could hit 7,000 by the end of the year.

China upped its gold reserves for a sixth straight month in April.

The Mag 7 may start leading the market rally after lagging behind "old economy" stocks.

In Case You Didn't Already Know This...

The Mag 7 aren't betting big on the AI transformation just because they like to burn money – AI is transforming how they actually operate. For example, MSFT CEO Satya Nadella said last week roughly 30% of Microsoft software code is written by – you guessed it – AI bots instead of humans.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.