Locking in Gains Without Selling

November 14, 2024

The Markets at a Glance

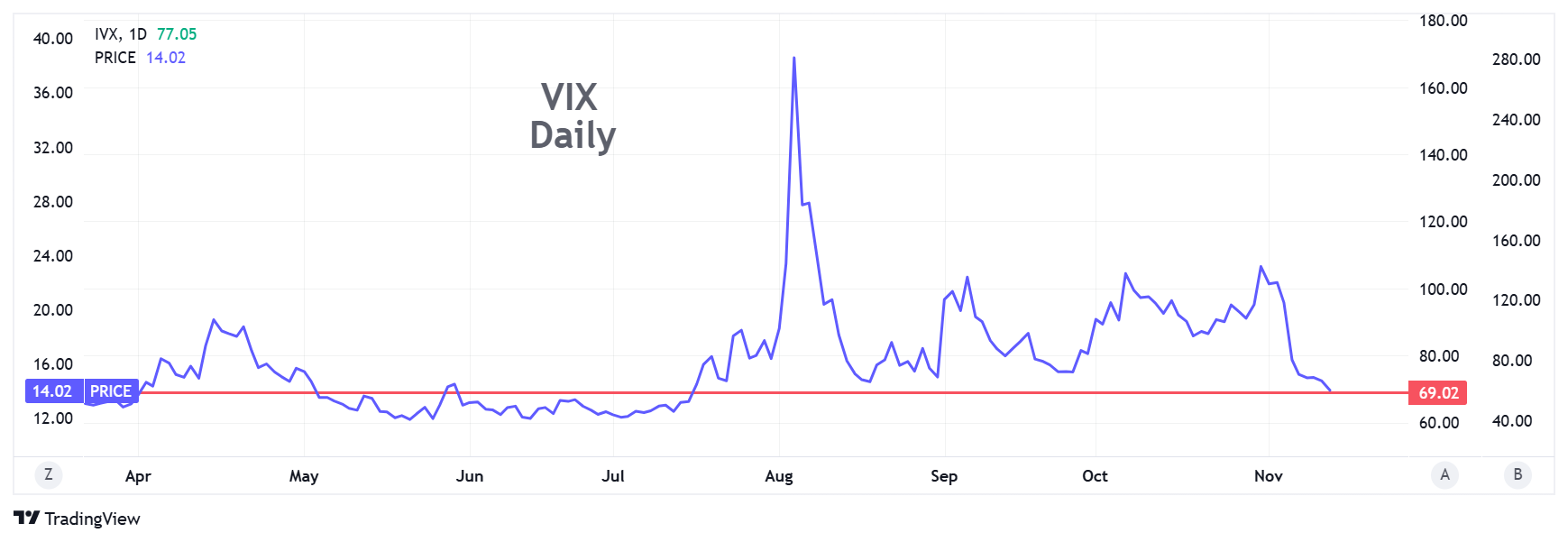

The markets have received a big new boost from the US election in a rally that is carrying all the major indexes to new highs. SPY, QQQ, and IWM are all participating and are once again at the upper boundaries of their existing uptrends. VIX accommodated by dropping sharply back to 14 – a level not seen since July and not far from the lows of the year back in the summer.

Having the small caps join the party already attended by the large caps and the tech stocks is definitely a confirmation on this move, but it does not take away the extended nature of the rally, especially when it will be well into 2025 when any new government policies begin showing up in company financials.

On one hand, this represents a strong boost to the existing upward momentum of the market, while on the other hand, it stretches already-extended valuations even higher. While clearly building on the grandiose pro-business, lower tax, high tariff promises of the new President, it is also getting way out in front of changes that will likely take months to materialize, if ever, and has the earmarks of emotional buying.

It would not be surprising to see at least some profit-taking during the lull between now and the year end, but when rallies occur toward the end of a calendar year, selling can sometimes stall until the new year for tax purposes. That said, though, there have been some short but sharp declines late in the year when traders simply get too nervous to continue holding into January.

Using options to solve that problem is the subject of this week's strategy talk.

Strategy Talk: Locking in Gains Without Selling

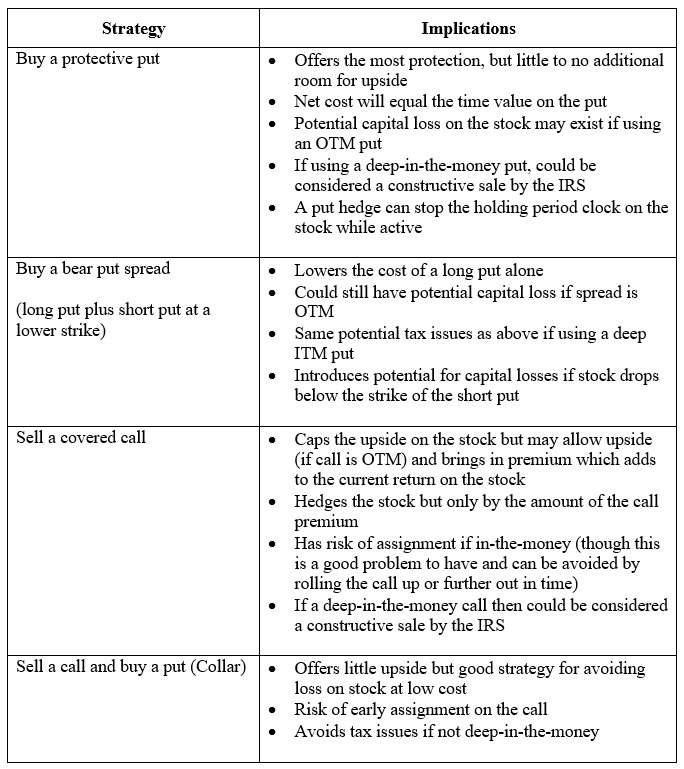

In a year with outsized gains like this one, a lot of people are no doubt sitting on profits they would like to take, but are either concerned the momentum will carry stocks further upward or dreading the capital gains tax they would pay for this year. Options are the best way to deal with either of these problems and there are multiple ways to use them.

The option strategies are straightforward hedging strategies. Bear in mind, however, that in a taxable account, some of these strategies might not be allowed to carry a gain over into the next tax year. I will mention some of the tax issues but will defer to IRS tax publication 550 for the official tax rules (starting on page 86), as they can be complicated.

Strategies for protecting a gain:

It is important to note that the tax rules can be complicated. The hedged position can be deemed a constructive sale the time of the put hedge or covered call, the holding period on the stock for long-term capital gains could be halted, or the combined stock and option could be subject to the straddle rule for tax purposes. I urge you to read the rules in Pub 550 or to consult a tax advisor if you have questions.

Meanwhile, however, you need not worry about the tax rules if any of the following are true:

- You implement the hedge in a non-taxable account, such as an IRA

- You avoid deep-in-the-money options

- You use options on a different stock – a proxy that is highly correlated with the stock you wish to hedge

The tax implications must be considered, but they should not deter you from using options to hedge gains until you are ready to realize them.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.