Back Spread Strategies

July 18, 2024

The Markets at a Glance

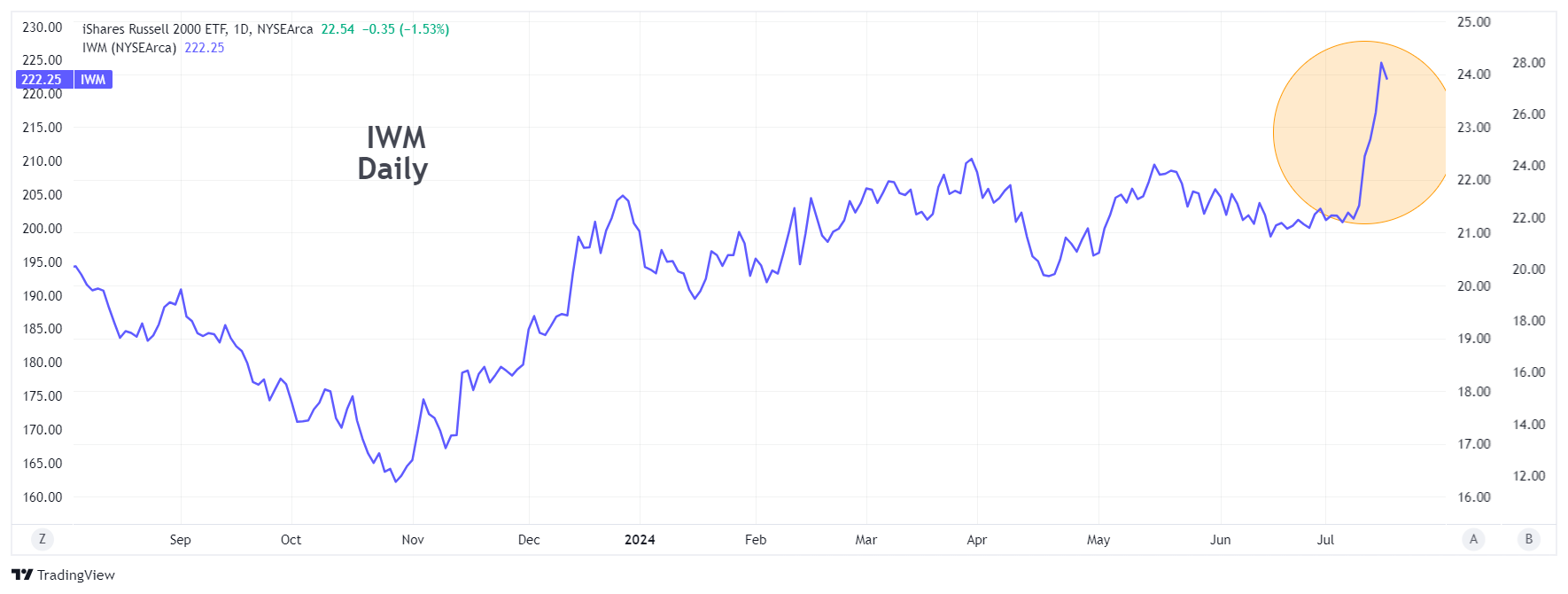

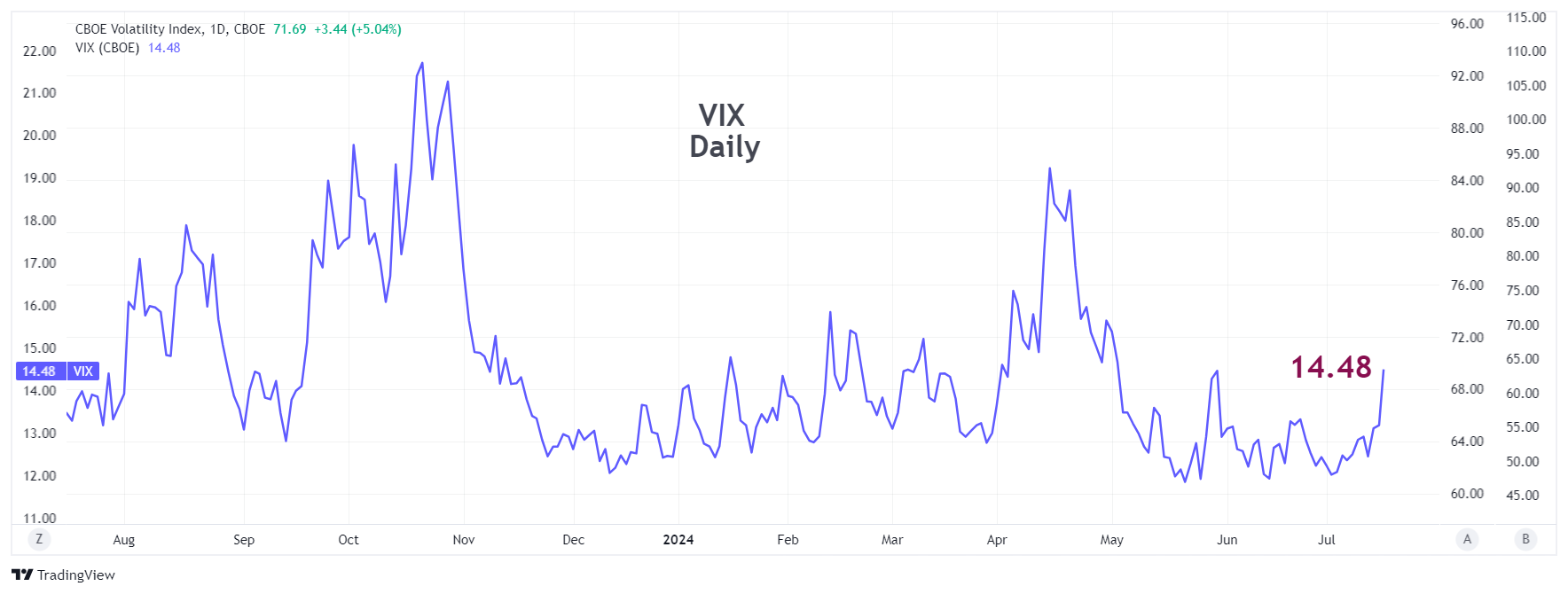

The SPY has turned slightly down, but not enough to even be noticeable inside its long-term uptrend this year. Meanwhile, however, high-flying tech stocks have backed off, with the gains seemingly being redirected into small cap stocks, as indicated by the surprise jump in the Russell 2000 ETF (IWM). That suggests a rotation, at least for the moment, rather than an impending top. But the VIX rose to 14.48, which suggests that at least some degree of put buying on the S&P 500 index is driving up the price of S&P options.

We are also likely seeing some of the effects of trading in issues deemed to benefit from (or be hindered by) the election of Trump as President. There has been a lot of press in the last few days referring to the "Trump trade" as a result of the increase in publicity outcoming from the attempt on his life and the Republican convention. That, in theory, should be somewhat temporary, especially given the closeness of this election.

So, we have the makings of a summer shake-up with higher volatility and some sizable pricing adjustments in both directions, such as SCHW (down 22% this week) and SOFI (up 30% this week). With moves of that magnitude, it seems like a good time to do a refresher on back spreads.

Strategy talk: Back Spreads

Back spreads are not an everyday strategy, but they are part of an option trader's toolkit that can be applied to certain situations. They are most applicable when a big move in a stock is expected.

When large moves are anticipated, implied volatility is usually high, making long put or call purchases very expensive. Bull or bear spreads can reduce some of the risk in expensive options but may still not provide an attractive risk-reward strategy. And buying a straddle in such situations has about the least possibility of making money of any strategy at all.

A back spread profits from a large move in a specified direction, while providing very low risk (or even a small gain) if the stock moves in the opposite direction. The risk is greatest for a move in the expected direction that is relatively small. So, the strategy is applicable when the trader expects a small move to be a low probability.

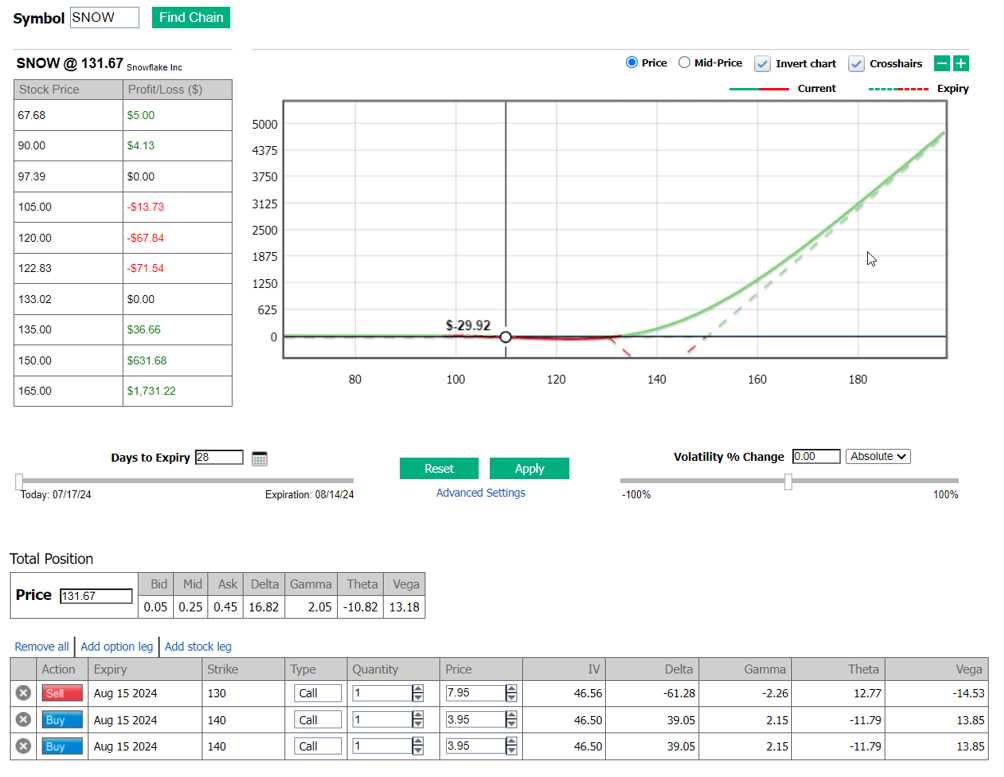

The back spread starts with a credit spread and uses all or most of the credit to purchase additional puts or calls. If the additional long options are at the same strike as the long side of the credit spread, it can be described as a ratio credit spread. An example would be Snowflake (SNOW). The stock dropped from 168 to 122 during the month of June. If you are looking for a potential rebound, you could always buy the stock, do a covered call write, or put on a diagonal call spread, but those strategies can take on a lot of risk and/or require a lot of capital.

Sell 1 SNOW Aug-15 130 call @ 7.95

Buy 2 SNOW Aug-15 140 calls @ 3.95

Net credit = .05

The back spread produces a very small credit, though ties up 10 points of margin to maintain the spread. That also means that further downside is not a risk. But there is risk on the upside until the spread gets covered and the extra calls kick in. The picture looks as follows:

There is a lot of flexibility in implementing a back spread, as you can vary both the strike prices of the two options as well as the ratio. A 3:1 ratio, for example, instead of the 2:1 ratio shown above, would mean a small loss for all prices below 39, a slightly deeper max loss, and a higher price to breakeven, but a faster acceleration of profits on the upside. Another modification could be to purchase the additional calls at a higher strike than the ones in the credit spread.

Traders using back spreads need to be aware that they are playing implied volatility as well as direction. If the stock's big move is the result of news, then implied volatility may shrink rapidly once the news is out, potentially reducing the profitability on the long calls.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.